API Posts Across-the-Board Inventory Draws

Oil prices are still climbing this morning after setting a new multi-month high yesterday. Prices settled just shy of the $55/bbl threshold, but they are making a second attempt today to clear the hurdle. After weeks of trading within a $2/bbl range, this week has brought a decisive change as prices move higher. Notably, the rally is spread throughout markets, with equity markets and even the US Dollar moving upwards as well. Falling COVID-19 cases and hospitalization in the US are inspiring hope that the worst of the pandemic is finally behind us.

Oil market balancing is driving the outsized oil rally, and the API’s reported across-the-board inventory draw will help propagate that narrative. The headline crude draw was 4.3 million barrels, far below the expected 1 million-barrel draw. Both diesel and gasoline also fell more than the market had expected. The EIA will release numbers later this number, and markets will be waiting to see if the bullish trend holds.

All eyes turn now to the OPEC monitoring meeting today, which isn’t expected to bring any concrete news but could paint a picture of OPEC’s thinking heading into its March meeting. OPEC’s March meeting will, in turn, yield insights on OPEC’s planned production for the rest of 2021. So far, the group has kept cuts higher than the original agreement. Back in spring 2020, the group agreed that its 2021 production would be cut by 5.7 MMbpd; last November, they upped their cuts to 7.2 MMbpd. Eventually, OPEC is expected to ease into their planned 5.7 MMbpd cuts, but timing is everything. Traders are hoping to glean some idea of OPEC’s easing plan from their technical guidance later today.

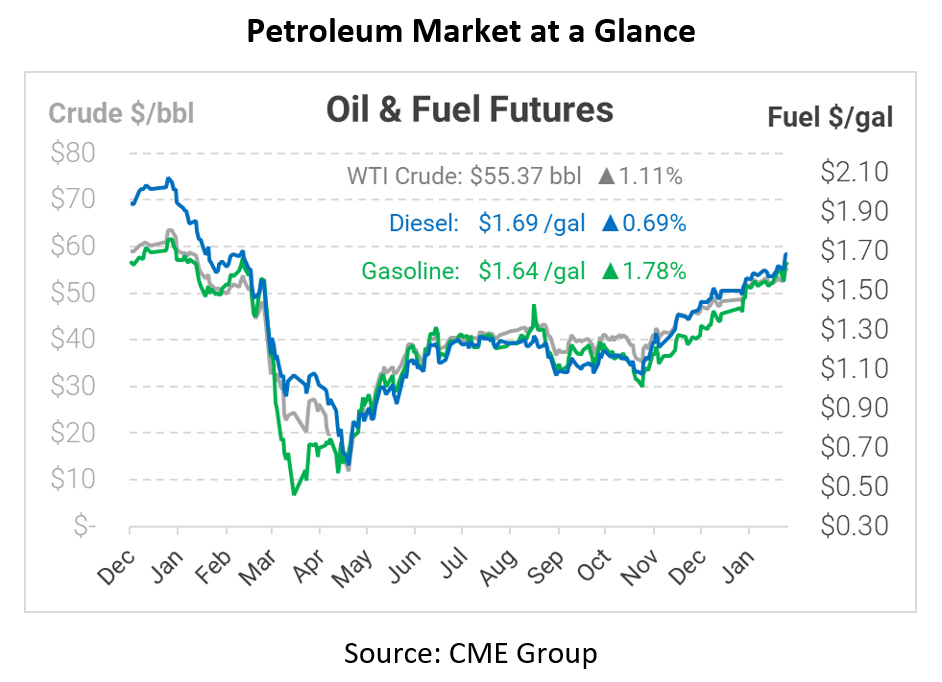

This morning, WTI Crude is trading at fresh highs, buoyed by strong demand and restrained supply. Crude is trading at $55.37, up 61 cents from yesterday’s close.

Fuel prices are also trading solidly higher this morning. Diesel prices are currently $1.6862, a gain of 1.2 cents over Tuesday’s closing price. Gasoline is $1.6448, up 2.9 cents.

This article is part of Daily Market News & Insights

Tagged: Inventories, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.