As New Cuts Take Effect, Analysts Warn of Future Supply Crunch

After putting in quite a run on Friday morning, WTI crude closed last week at its lowest level since Jan 7 – though that’s not exactly saying much, as the product has yet to escape the $52-$53 range. This morning, Saudi Arabia’s incremental 1 MMbpd of cuts go into effect, markets are moving higher in anticipation of falling global inventories.

Demand is slowly recovering, but it’s the supply side that has many analysts forecasting the next severe price shock. Bloomberg points out that capital expenditures from oil majors are at a ten-year low due to extreme spending cuts. Reduced spending now means less supply in the future, usually at a 3-5 year lag. Last week, OPEC’s Secretary-General warned of “extreme volatility down the road.”

This isn’t the first time analysts have sounded the capex alarm. Back in 2014-15, when OPEC opened the hatches and sent oil spiraling to $40/bbl, analysts expected a severe supply crunch by the end of the decade. Instead, US shale remained resilient, and oil ended the 2010s at historically mediocre levels. Now, there’s a real question whether US shale will once again balance global markets. One line of thinking suggests shale companies have been permanently scared out of high-growth targets. On the other hand, when prices rise high enough, the profits could be too tempting. Add in a plethora of clean energy targets from oil majors and developed nations alike, and it’s unclear whether oil will have a smooth transition out of the spotlight or a bumpy, volatile path to becoming a second-tier energy source.

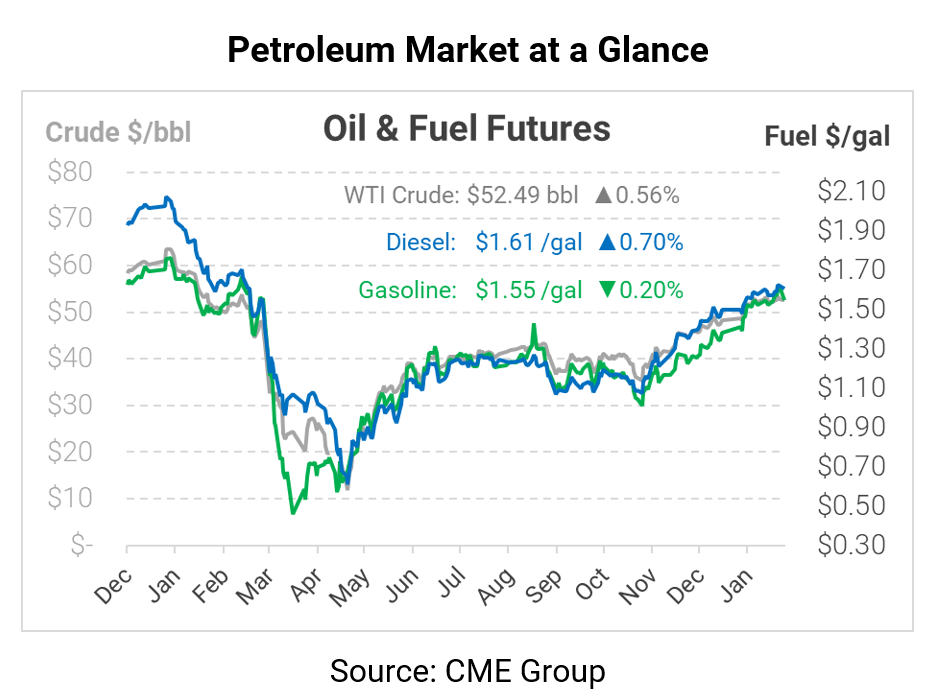

This morning, oil prices are trading mixed. Crude oil is trading at $52.49, up 29 cents since Friday but down from early morning highs.

Fuel prices are uneven, with gasoline falling even as diesel creeps higher. Diesel fuel, propelled by chilly weather in the Midwest and Northeast, is trading at $1.6096, up 1.1 cents since Friday. Gasoline is trading lower at $1.5496, down 0.3 cents.

This article is part of Daily Market News & Insights

Tagged: Saudi Arabia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.