Biden Team Reverses Trump-era Environmental Policies

Just a day into the new Biden administration, the President is busily undoing many of Trump’s environmental policies. On his first day, President Biden signed an executive order to re-enter the United States into the Paris Accord, an international climate agreement pledging carbon reductions over the next decade. He also threatened to cancel the Keystone XL Pipeline, though its operator TC Energy beat him to the punch by announcing the project was suspended. The transition team reported that it’s evaluating vehicle fuel economy standards, which were relaxed by the Trump administration.

Although these regulations have a clear impact on oil companies, it’s unclear what the net price impact will be. Some policies raise the cost of producing and distributing oil, which would push fuel prices higher. Conversely, fuel efficiency would reduce demand, causing prices to fall. Similarly, the President’s pro-biofuel stance could move demand from petroleum to renewable fuels, lowering consumer costs. [For more on the future of biofuels, join our webinar next Tuesday as biofuel expert Sara Bonario reviews recent trends in biofuel regulations.]

While the world watches the new administration, the petroleum industry continues ticking forward. The API released their weekly inventory data last night, a day delayed due to the long holiday weekend. The report showed a surprise build for crude oil, with the product rising 2.6 million barrels. Both diesel and gasoline posted stock builds as well. The EIA will not publish their report until Friday, delayed two days by MLK Day and the inauguration.

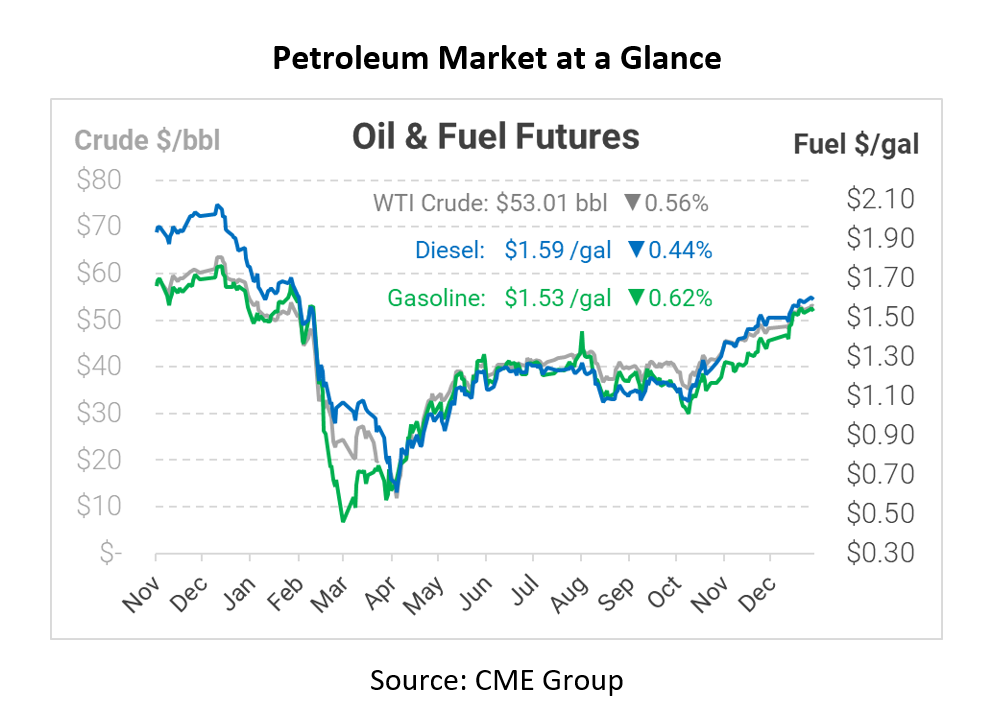

This morning, all markets seem to be retreating from recent gains. Crude oil is trading at $53.01, a loss of 30 cents.

Fuel prices are dropping lightly on news of the inventory builds. Diesel is trading at $1.5934, a loss of 0.7 cents. Gasoline prices are $1.5343, down a penny from yesterday’s closing price.

This article is part of Daily Market News & Insights

Tagged: API inventories, Biden

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.