Vaccine News Sparked this Multi-Week Rally

On Tuesday, WTI crude closed higher as the vaccine rollout continues and hopes for another round of economic stimulus in the US grows. The market is giving back some of those gain this morning even in the face of favorable inventory news from the API.

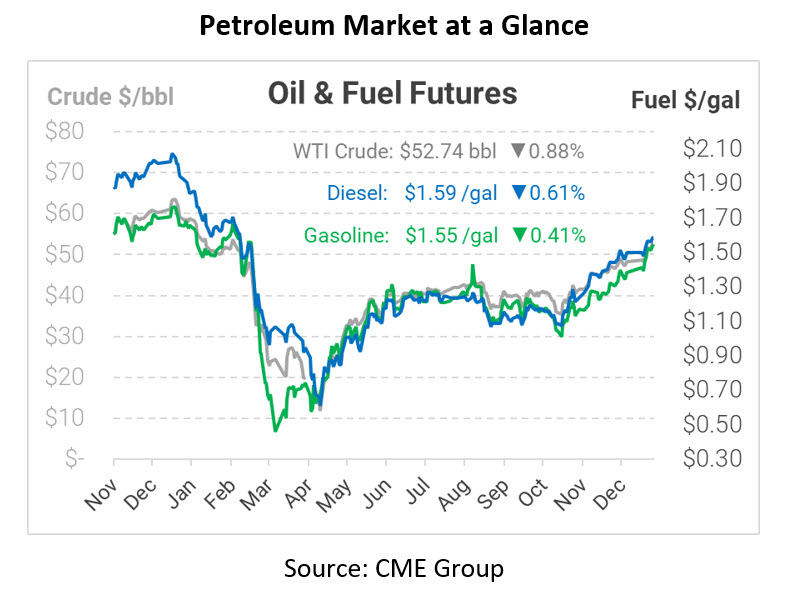

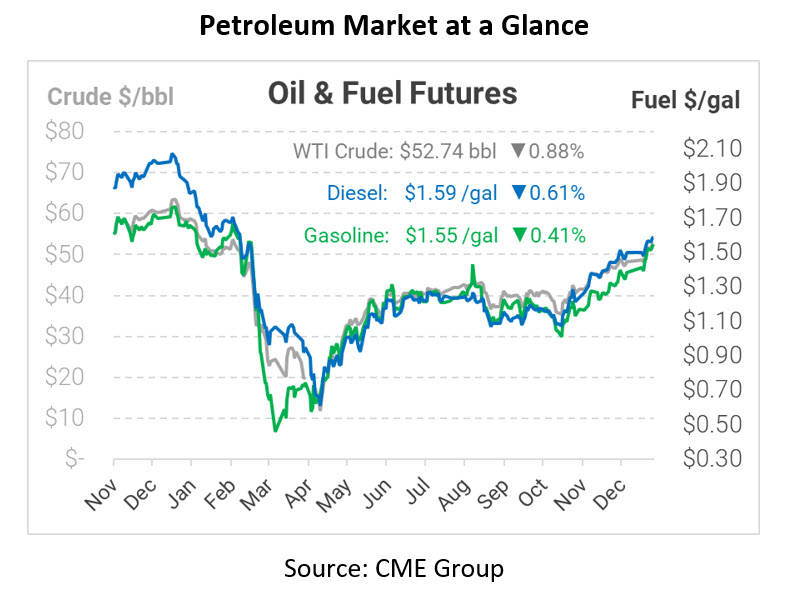

The rally that the market has been on began in earnest in November of last year when vaccine news first hit the market. The trend is exemplified in the arc of NYMEX heating oil contracts. Since November, there have been 31 up days for HO (out of 48) with an average upward move of +$0.0232/gallon. There has been a total of 17 down days (out of 48), with 9 of those down days down less than a penny. The average downward move was -$0.0138/gallon.

What does the above data mean? The market has not seen a lot of volatility – it has solidly been in an upward trend. Can we expect to see a correction soon with the market close to recapturing all the losses sustained during the pandemic? Only time will tell.

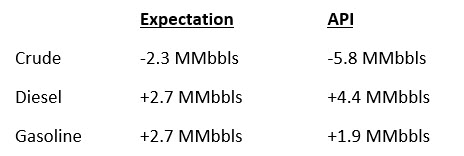

The API’s data last night:

The API reported a larger-than-expected draw for crude of 5.8 MMbbls versus an expected draw of 2.3 MMbbls. At Cushing, they had a draw of 0.2 MMbbls. The API reported that distillates had an increase in stocks. Gasoline inventories had an increase. The EIA will report numbers later this morning.

Crude prices are down this morning. WTI Crude is trading at $52.74, a loss of 47 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.5870, a loss of 1.0 cents. Gasoline is trading at $1.5466, a decrease of 0.6 cents.

This article is part of COVID-19

Tagged: API, diesel, Heating Oil, vaccine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.