Hope for Third Round of Stimulus is Growing

Crude closed up only a penny yesterday but is hitting 11-month highs this morning. The continuation of last weeks’ rally based upon voluntary production cuts from Saudi Arabia and a weaker dollar is helping to lift markets. In addition, the easing of coronavirus restrictions and the ensuing uptick in travel and economic activity along with the rising hopes for additional coronavirus economic stimulus in the US are helping crude to rise to levels not seen since February of last year.

After the recent Georgia elections, the Democrats have secured a narrow margin of control in the Senate. President-Elect Biden is expected to unveil a multi-trillion-dollar stimulus plan this week. With majority control in the House and Senate, Biden has greater ability to enact a third coronavirus economic stimulus package, which could include $2,000 direct payments to individuals. Senator Joe Manchin, a Democrat from West Virginia, has expressed some hesitancy around $2,000 payments to individuals if they are not targeted to those in need.

The third stimulus plan’s success will rely upon the votes of all 50 Democrats in the Senate. It is expected that all 50 Republicans will vote against the bill. Under a process called “budget reconciliation,” the Democrats would need a simple majority to enact the bill, which they have with Vice-President-Elect Harris as the tie-breaking vote.

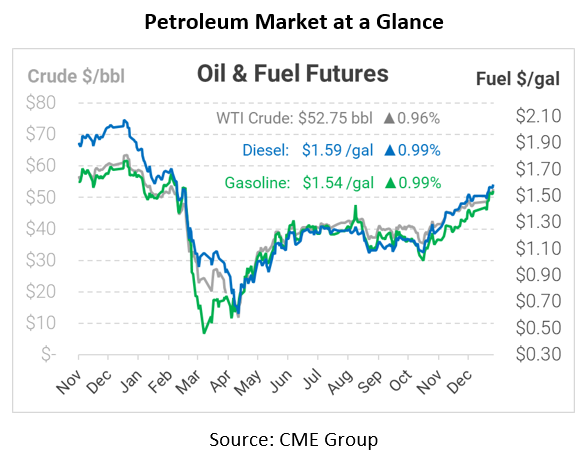

In early trading today, crude prices are up. Crude is currently trading at $52.75, a gain of 50 cents.

Fuel prices are up this morning. Diesel is trading at $1.5890, a gain of 1.6 cents. Gasoline is trading at $1.5359, a gain of 1.5 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.