Vaccine Hopes Outweigh Bearish Inventory News

On Tuesday, WTI crude closed down slightly as US coronavirus cases topped 15 million. This bleak threshold was tempered by optimism in the market around the hope for vaccines’ success. Crude is up in early trading this morning as bearish inventory news is outweighed by news of the beginning of a mass vaccination program in the United Kingdom.

Yesterday, the United Kingdom began a mass coronavirus vaccination program. This program is the first among Western nations and is being watched closely by the US and other countries. The UK program will be used as a proving ground for logistics and implementation of the vaccine, which requires special handling and storage. The first recipients of the Pfizer-BioNTech vaccine were health workers and the elderly. The same vaccine used in the UK is currently going through emergency FDA approval in the US and will likely begin shipments this month. Traders are keeping a close watch on the vaccine rollout, and there is optimism that the world is turning the corner on the pandemic.

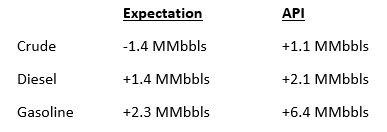

The API’s data last night:

The API reported a surprise build for crude of 1.1 MMbbls versus an expected draw of 1.4 MMbbls. At Cushing, they had a draw of 1.8 MMbbls. The API reported that distillates had an increase in stocks. Gasoline inventories had a large increase. The EIA will report numbers later this morning.

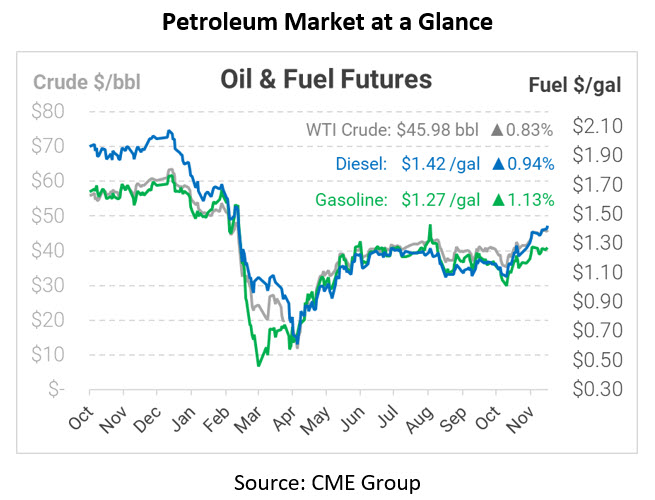

Crude prices are up this morning. WTI Crude is trading at $45.98, a gain of 38 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.4199, a gain of 1.3 cents. Gasoline is trading at $1.2701, an increase of 1.4 cents.

This article is part of Daily Market News & Insights

Tagged: API, coronavirus, United Kingdom, vaccine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.