Vaccine Optimism Trumps Bearish Inventory News

On Tuesday, WTI crude closed sharply higher following US equities. The Dow Jones Industrial Average closed above 30,000 for the first time in history and crude followed to levels not seen since March. The major drivers lifting markets are news of multiple highly effective coronavirus vaccines and the beginning of the official transition of power to president-elect Biden. Both factors are playing a role in the rally we are seeing continue in crude this morning.

In inventory news, the API reported a larger-than-expected build in crude and gasoline stocks. The market appears to be shrugging off the bearish news. Instead, they are focused on the promising demand outlook created by the news of three vaccines to combat the coronavirus. While coronavirus infections around the world are climbing, traders seem more focused on longer term factors affecting future prices.

The API’s data last night:

The API reported a large build for crude of 3.8 MMbbls versus an expected build of 0.1 MMbbls. At Cushing, they had a draw of 1.4 MMbbls. The API reported that distillates had a decrease in stocks. Diesel demand is climbing and is now on par with pre-COVID levels. Gasoline inventories had an increase. As states are implementing lock-downs, gasoline demand is beginning to drop. Last week, gasoline demand fell to the lowest point since June. Leading into the holiday weekend, traders will be closely monitoring today’s EIA report for clues about the evolving demand picture. The EIA will report numbers later this morning.

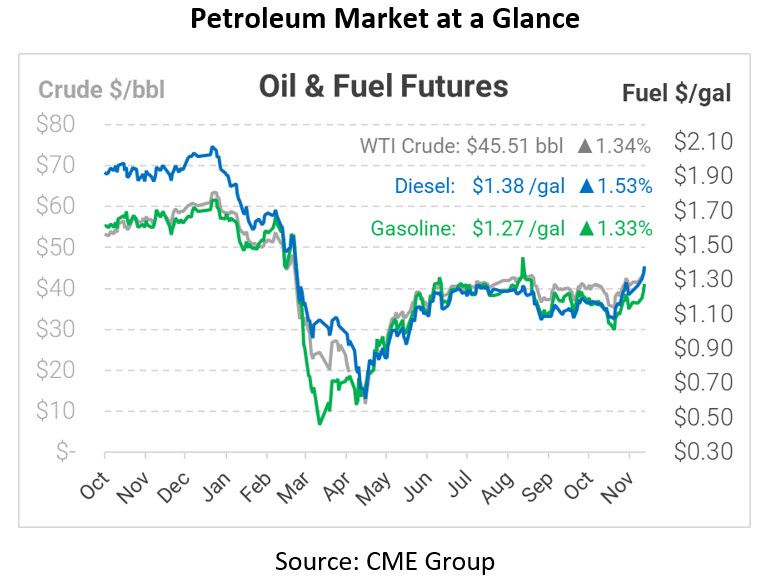

Crude prices are up this morning. WTI Crude is trading at $45.51, a gain of 60 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.3803, a gain of 2.1 cents. Gasoline is trading at $1.2749, an increase of 1.7 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, demand, inventory, vaccine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.