Yet Another Vaccine Boosts 2021 Outlook

Oil prices are rising this morning following yet another vaccine, Oxford-AstroZenaca, announcing results showing an average 70% effectiveness. Behind that average, though, the study found that certain doses were as much as 90% effective. Numerous vaccines mean more producers can work on manufacturing simultaneously, meaning more vaccines available sooner for distribution.

The head of America’s vaccine program reported that limited quantities of vaccines could be distributed in December following FDA approval, with widespread immunity coming as soon as May 2021. Given that timeline, oil demand could return to normal as soon as Q2 2021.

With all the volatility in fuel prices, it can be helpful to maintain a view forward to anticipate changes in the market. Back in September, Mansfield supply team members provided forecasts of how crude oil prices might end 2020.

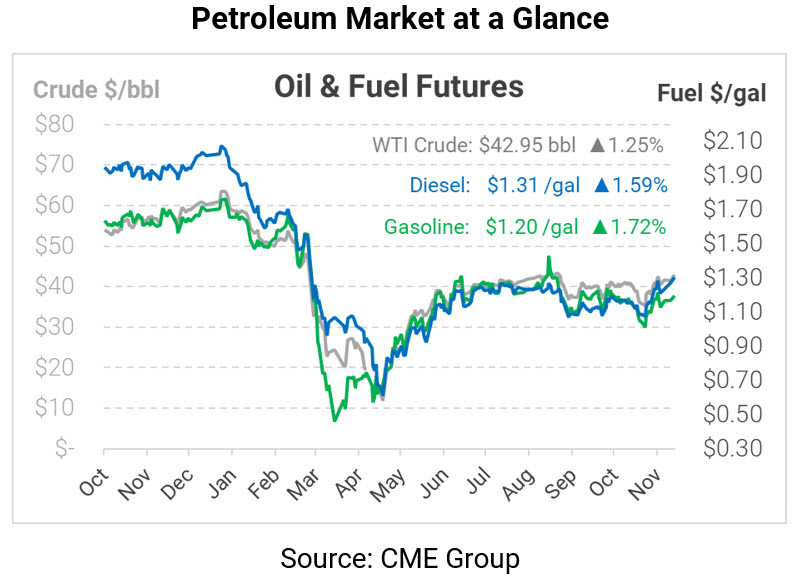

This morning, markets are moving higher as traders hope for rising demand in the near future. In addition, consensus is building that OPEC+ will maintain current cut levels through Q1 2021, which would keep an extra 1.9 MMbpd off the market compared to current Q1 cut levels. Crude oil is trading at $42.95 this morning, up 53 cents to the highest level since early September.

Fuel prices are also soaring today. Diesel is trading at $1.3067, up 2 cents from Friday’s closing price. Gasoline is trading at $1.1954, also gaining 2 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.