Week in Review – November 20, 2020

WTI crude finished the week higher, starting up on Monday with news of another effective vaccine lifting the market throughout the week. This new vaccine by Moderna reported 95% efficacy rates and a more manageable storage temperature.

An inventory build in crude mid-week put downward pressure on the market but could not overcome OPEC optimism coming out of their meeting on Tuesday. A large diesel draw was bullish for distillates and helped diesel finish the week over 10% higher. Traders expect OPEC later this month to continue current supply cuts into 2021 as demand continues to falter due to the coronavirus and Libya returns barrels to the market.

Also in OPEC news, there are rumors of the UAE considering leaving OPEC. The UAE is reportedly unhappy with discussions of extending current deep supply cuts when other members are not complying with previous and current cuts. The UAE is the third-largest producer in OPEC.

Prices in Review

WTI Crude opened the week at $40.17. It followed a choppy path to close the week higher. Crude opened Friday at $41.70, an increase of $1.53 (3.8%).

Diesel opened the week at $1.1498. It rose to mid-week after a reported draw and leveled off to close the week up. Diesel opened Friday at $1.2744 a gain of 12.5 cents (10.8%).

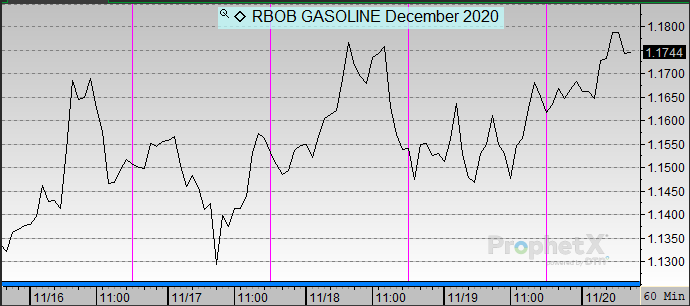

Gasoline opened the week at $1.1250. It followed crude throughout the week to close the week higher. Gasoline opened Friday at $1.1650, a gain of 4.0 cents (3.6%).

This article is part of Daily Market News & Insights

Tagged: COVID-19, forward curve, vaccine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.