Contested Election Likely, Markets Move Lower

Crude is lower in early trading this morning, continuing yesterday’s losses. Prolonged uncertainty in the US election is weighing on markets as Trump is suggesting the election process is not playing out fairly.

Trump has begun filing lawsuits in several states to remedy what he believes are illegal practices in the election process. So far there has been little to no corroboration of his claims with no high-level Republican leaders coming out to support his views. The counting process is continuing now and there may be a winner declared as early as today, but with grumbling from the White House and multiple pending lawsuits, a prolonged contested election seems likely.

Experts expect a contested US election will likely be bearish for oil. Markets do not like uncertainty and traders have been pushing prices lower yesterday and today. Biden is currently in the lead in electoral votes and in key contested states. Should Biden win, it is expected he would have a softer stance with Iran which could bring 1 MMbpd to the market if sanctions were lifted and this would drive prices lower if OPEC does not take some action.

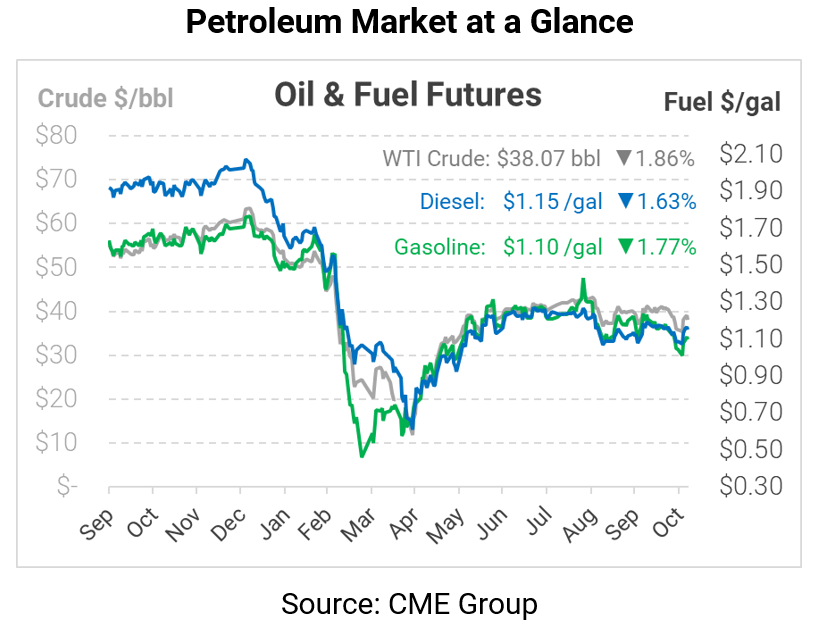

Crude prices are down this morning. WTI Crude is trading at $38.07, a loss of 72 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.1505, a loss of 1.9 cents. Gasoline is trading at $1.0961, a decrease of 2.0 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.