Week in Review – October 30, 2020

The week had several major factors driving the market this week. The one bullish factor was the reassurance by OPEC that they would continue to balance the market. Secretary General Barkindo of OPEC assured the market that OPEC would remain vigilant and would intercede to balance the market as necessary.

Several bearish triggers drove the market lower starting mid-week including the fear of a slowing demand recovery due to rising coronavirus cases. In addition, the diminishing hope of economic stimulus in the US before November and the prospect of a contested election put downward pressure on crude and US Equities.

In inventory news, a larger-than-expected build in crude and a surprise build in gasoline offset the effects of a large draw in diesel. On the supply side, the return of Libyan barrels to the market caused concern among traders of a supply glut. The bearish factors drove markets lower this week.

Prices in Review

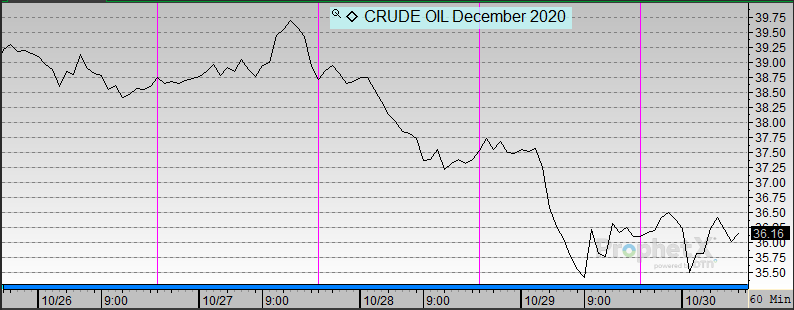

WTI Crude opened the week at $39.69. It followed a downward path starting mid-week after inventory news from the EIA. Crude opened Friday at $36.07, a decrease of $3.62 (-9.1%).

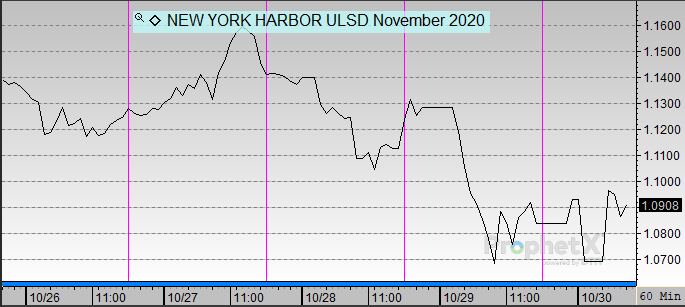

Diesel opened the week at $1.1488. It dropped precipitously mid-week and after. Diesel opened Friday at $1.0929 a loss of 5.6 cents (-4.9%).

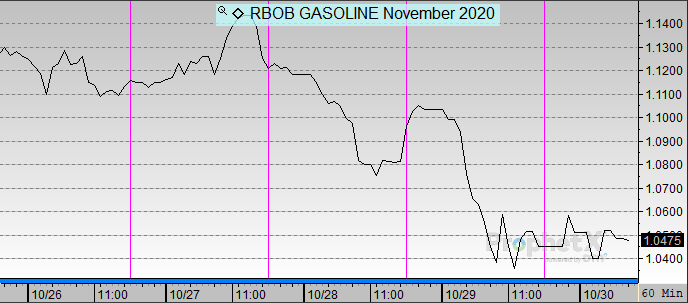

Gasoline opened the week at $1.1335. It followed a generally downward track starting mid-week to close the week lower. Gasoline opened Friday at $1.0532, a loss of 8.0 cents (-7.1%).

This article is part of Daily Market News & Insights

Tagged: coronavirus, demand, lockdowns

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.