OPEC Leader Cautiously Optimistic

Crude closed down over 3% on Monday, following US equities lower as traders wrestled with rising numbers of coronavirus cases as well as the diminishing possibility of a US stimulus deal before the election. Crude is trading higher this morning as the storm churning in the Gulf is temporarily shutting in supply. Gulf of Mexico operators shut in 294 kbpd of production ahead of Hurricane Zeta making landfall along the US Gulf Coast tomorrow.

OPEC has reaffirmed its stance to balance the market. The pace of oil and products demand recovery due to the second wave of coronavirus cases in the US and Europe has caused concern among traders and investors. “We remain cautiously optimistic that the recovery will continue. It may take longer, maybe at lower levels, but we are determined to stay the course,” OPEC Secretary General Mohammad Barkindo said on Monday. Speculation is growing around whether OPEC+ will ease supply cuts in January as planned or if they will extend cuts further. OPEC’s Barkindo went on to say, “We are determined to assist the market to restore stability by ensuring that the stock drawdowns continue in order to restore the supply-demand balance.”

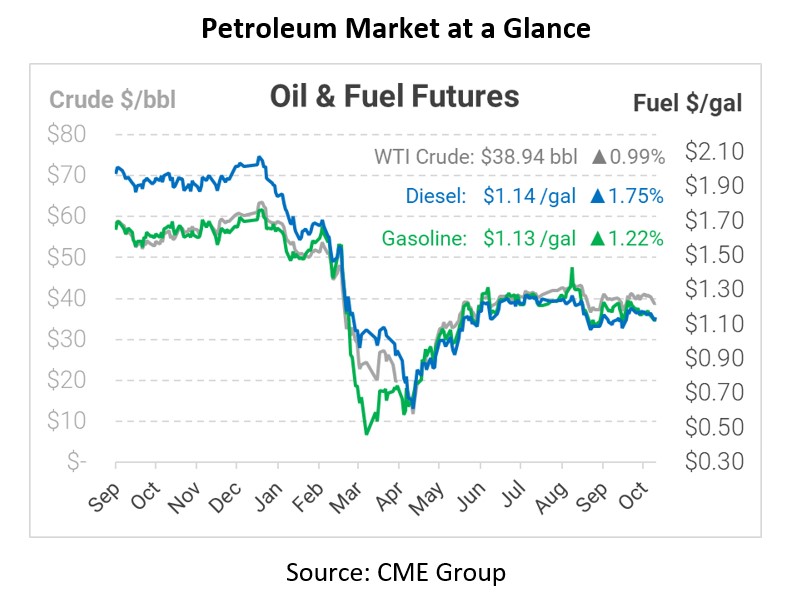

In early trading today, crude prices are up. Crude is currently trading at $38.94, a gain of 38 cents.

Fuel prices are up this morning. Diesel is trading at $1.1414, a gain of 2.0 cents. Gasoline is trading at $1.1252, a gain of 1.4 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, hurricane, opec, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.