OPEC+ Meets amid String of Bearish Trends

Markets are mixed this morning as traders focus on rising COVID-19 cases and the resumption of Libya’s oil production. The demand outlook for this winter is becoming increasingly dismal, and the prospects of a US stimulus package passing before the election seem low. Oil markets are watching OPEC+’s meeting today for signs of any changes in their cut strategy. Although no changes are expected in the near-term, this meeting could begin a push for future cuts.

US producers are beginning the long, slow path to normal, with oil rigs posting their fifth consecutive weekly gain. On Friday, Baker Hughes reported rigs rising by 12 rigs to 282 total, up 15% from August’s bottom of 244 rigs. Historically, crude prices of $40/bbl is just barely enough to keep shale production alive, with $45-$50 more comfortable for American companies. The 15% hike seems like a blip compared to the 65% drop from pre-pandemic levels. Further, rising rigs don’t immediately translate into more production, so there will be a lag between rebounding activity and higher US supplies.

In further bearish news, China seems to be backing down its purchases of crude oil. The country has been sucking up nearly 13% of global supplies during the pandemic period of April-September, according to Reuters. But that buying spree may not last; the article continues that imports may fall by 1.7 MMbpd in the final months of the year. Libya adding half a million barrels per day to global production stunted the market’s rally and has kept prices laggard for weeks. If the data confirms that China is cutting its demand by such a large amount, it could send prices tumbling below $40/bbl again unless other global demand rises to offset the loss.

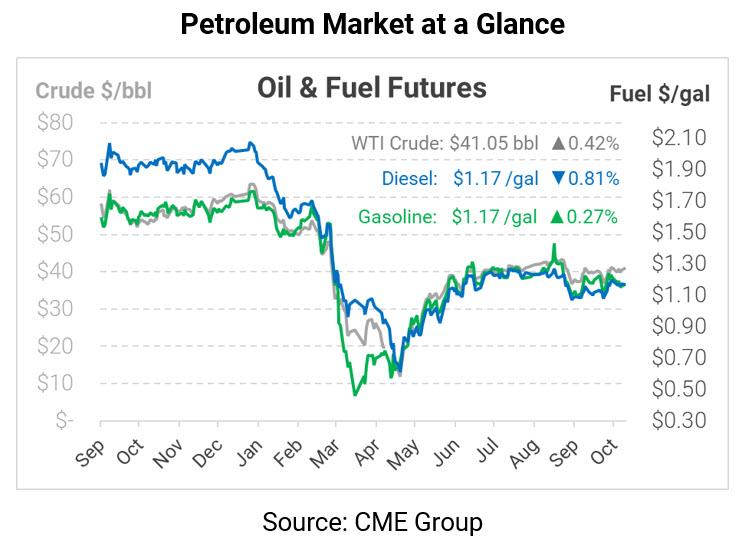

Despite what seems like a bearish sentiment in headlines, oil prices are trading sideways as markets hope for progress from OPEC+. Crude oil is trading at $41.05, a small gain of 17 cents per gallon.

Fuel prices are mixed this morning, with diesel moving lower while gasoline rises back to the top of the refined products mix. Diesel is trading at $1.1696, down almost a penny from Friday’s closing price. Gasoline is making small gains, up 0.3 cents to $1.1720.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.