Surging Infections Trouble Market

WTI crude is down sharply in early trading this morning. New restrictions to slow the surge of coronavirus cases has increased uncertainty about the pace of economic and fuel demand recovery:

- London: Tighter COVID-19 restrictions are expected to take effect starting at midnight on Friday.

- France: Nearly a third of the population is under a nightly curfew to stem the tide of surging COVID-19 infections in the country.

- India: Concerns are rising that they will overtake the US in overall number of infections, and infections are rising heading into two major Indian holidays – Durga Puja next week and Diwali in November. Holiday travel may cause rising infections in the country.

OPEC and its allies had 102% compliance with stated cuts in September, with officials noting that oil demand was recovering more slowly than expected. Prices have been stagnant even with OPEC’s cuts. With rising coronavirus cases putting pressure on prices, OPEC+ will have a difficult decision to make in January. If they increase production, they risk deflating prices once again.

The API reported a larger-than-expected draw for crude of 5.4 MMbbls versus an expected draw of 2.8 MMbbls. At Cushing, stocks increased by 2.2 MMbbls. The API reported that distillates and gasoline had a decrease in stocks. The EIA will report numbers later this morning.

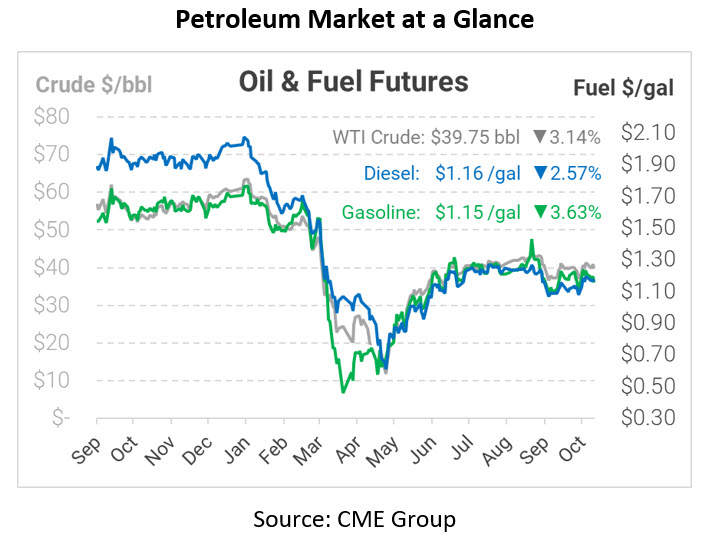

Crude prices are down this morning. WTI Crude is trading at $39.75, a loss of $1.29.

Fuel is down in early trading this morning. Diesel is trading at $1.1619, a loss of 3.1 cents. Gasoline is trading at $1.1536, a decrease of 4.4 cents.

This article is part of Daily Market News & Insights

Tagged: API, coronavirus, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.