Natural Gas News – October 8, 2020

Natural Gas News – October 8, 2020

EIA sees rising US gas demand, exports pushing up winter Henry Hub prices

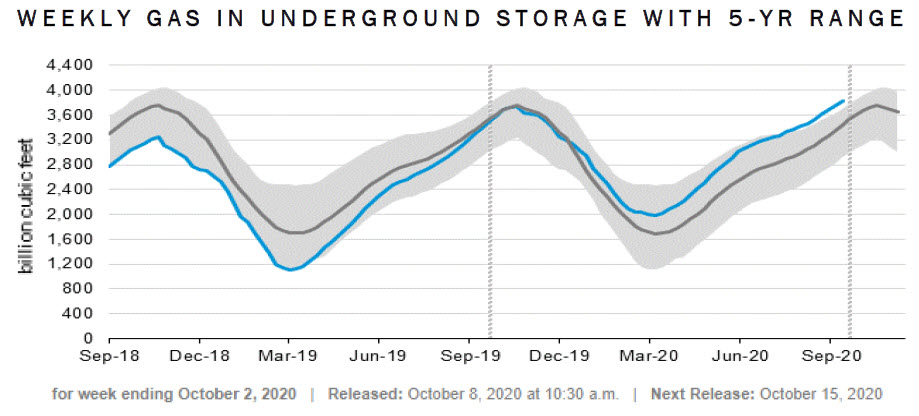

Rising domestic demand for natural gas and improved LNG exports heading into the winter are likely to combine with declining production to push up Henry Hub spot prices to average $3.38/MMBtu in January 2021, the US Energy Information Administration said Oct. 6. In its October Short-term Energy Outlook, EIA also forecast that spot gas prices would stay above $3.00/MMBtu throughout 2021. Total market production was estimated to decline from an average of 100.04 Bcf/d in 2019 to 93.88 Bcf/d in 2020 and 94.38 in 2021, although the levels were up from the prior forecast. EIA raised its fourth quarter production estimate by 2.15 Bcf/d to 96.48 Bcf/d and its its Q1-21 production forecast by 1.24 Bcf/d to 94.04 Bcf/d. For more on this story visit spgglobal.com or click https://bit.ly/2GCs8bR

Tacoma: new LNG hub comes to North America’s west coast

A deep-water, major shipping hub in the US Pacific Northwest, the Port of Tacoma will soon be home to a new LNG facility capable of refuelling marine vessels. Jointly owned by Washington State utility Puget Sound Energy (PSE) and its commercial, sister company Puget LNG, Tacoma

LNG has achieved several industry ‘firsts’ since its ground-breaking on 1 November 2016. One of these ‘firsts’ is that when it opens in Q2 2021, Tacoma LNG will be the first LNG bunkering terminal on the west coast of North America. Moreover, it will serve a shared function, providing LNG for Puget LNG’s commercial customers, and the necessary natural gas reserves for PSE’s utility customers. For more on this story visit rivieramm.com or https://bit.ly/36Lw8kP

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.