Week in Review – September 25, 2020

WTI crude finished lower for the week from Monday’s open to Friday’s open. Fears of Libyan crude deepening the oil glut caused markets to fall on Monday. The imminent return of 1 MMbpd of Libyan supply spooked the market to start the week.

Tropical Storm Beta caused flooding in Houston and Louisiana, but most of the energy complex was spared. The storm was practically a non-event for supply and the markets acted accordingly.

The US Department of Transportation reported that US drivers drove 11% less in July than last July. The lockdowns due to the pandemic kept drivers off the roads during peak driving season this year.

Federal Reserve Chairman called for an injection of cash into the economy in front of Congress this week. He noted how important a stimulus package would be to the recovery of the faltering economy. Many believe the deadlocked congress will be unable to come to an agreement over a stimulus package before the November election.

Prices in Review

WTI Crude opened the week at $40.98. It opened down then tracked sideways throughout the week. Crude opened Friday at $40.15, a decrease of 83 cents (-2.0%).

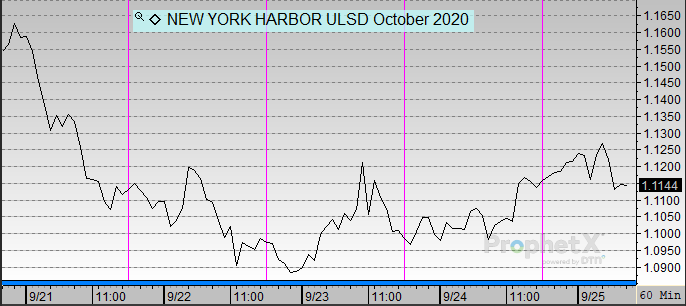

Diesel opened the week at $1.1545. It generally followed crude throughout the week. Diesel opened Friday at $1.1120 a loss of 4.3 cents (3.7%).

Gasoline opened the week at $1.2320. It followed crude throughout the week to close the week lower. Gasoline opened Friday at $1.1933, a loss of 3.9 cents (3.1%).

This article is part of Daily Market News & Insights

Tagged: California, imports, Net Exporter

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.