Crews Returning to Oil Platforms in the Gulf

On Wednesday, WTI crude closed $1.88 (4.9%) higher. Supporting prices was EIA inventory news of a surprise draw. Also lifting prices was Hurricane Sally’s effects on production. Crude is giving back some of those gains in early trading this morning.

Crude producers are preparing to send crews back to oil platforms in the Gulf as the storm passes. Hurricane Sally had shut-in production of nearly 500 kbpd for the past five days. This crude supply cut helped to lift prices over the past few days. We can expect to see the impact in inventory numbers next week, but the market will likely price in that decrease beforehand. In addition, the return of 500 kbpd of production to the market will certainly be bearish for prices.

OPEC and its allies will meet virtually later today to discuss how best to balance the market. The economic slowdown due to the recent resurgence of the coronavirus is a concern for them. According to Reuters, global coronavirus cases are expected to pass 30 million today. OPEC will need to consider how much the pandemic will affect oil demand and then take action accordingly.

This week the EIA reported that crude fell to its lowest level since April. They reported a surprise decrease for crude of 4.4 MMbbls, versus an expected increase of 1.3 MMbbls. At Cushing, the EIA reported that stocks fell by 0.1 MMbbls. US crude oil inventories are about 14% above the five-year average for this time of year. Distillates reported a build and continue to trend roughly 22% above the five-year average. Gasoline inventories had a draw and are about 3% above the five-year average.

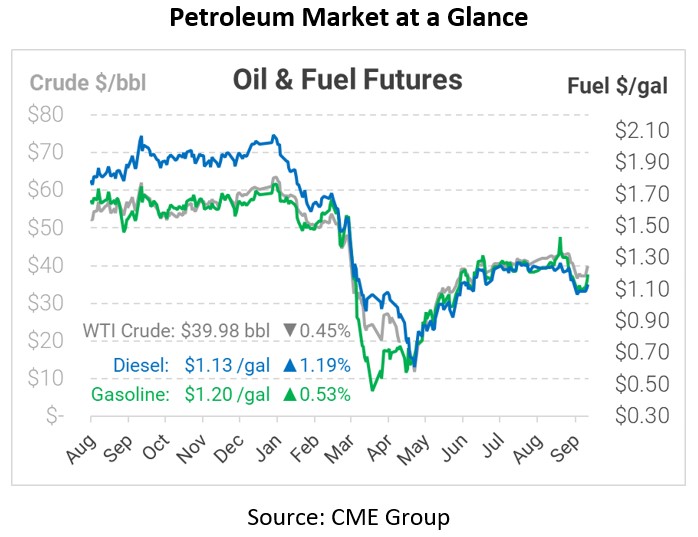

Crude prices are down this morning. WTI Crude is trading at $39.98, a loss of 18 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.1296, a gain of 1.3 cents. Gasoline is trading at $1.1952, an increase of 0.6 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.