OPEC to Meet to Discuss Future Cuts and Compliance

On Tuesday, WTI crude closed higher even after the IEA warned about the pace of economic recovery from the pandemic and downgraded demand forecasts from the IEA and OPEC. A considerable surprise crude draw and the closure of production due to Hurricane Sally are lifting markets this morning. Crude is continuing its gains in early trading this morning.

OPEC will meet tomorrow to discuss current and future production cuts going into the low demand season. OPEC will likely stay the course with recent production cuts remaining in place. Compliance with current cuts by some countries who have produced above their quotas will be a point of discussion. Nigeria, Iraq, and the UAE have been producing more than their share and will need to come back in line with supply cuts going forward.

The API’s data last night:

The API reported a surprise draw for crude of 9.5 MMbbls versus an expected build of 1.3 MMbbls. At Cushing, stocks decreased by 0.8 MMbbls. The API reported that distillates had a decrease in stocks. Gasoline inventories had a surprise increase. The EIA will report numbers later this morning.

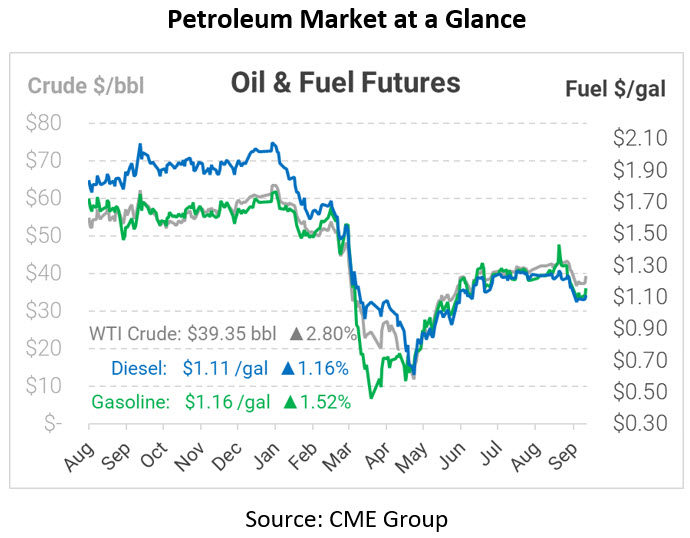

Crude prices are up this morning. WTI Crude is trading at $39.35, a gain of $1.07.

Fuel is up in early trading this morning. Diesel is trading at $1.1121, a gain of 1.3 cents. Gasoline is trading at $1.1554, an increase of 1.7 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.