Market Weighs Storm Effects Versus Downgraded Forecasts

Markets are trading higher this morning with prices supported by concerns over Hurricane Sally hitting the Gulf Coast and an increase in August demand reported out of China. China’s oil demand increased 9.9% in August. Year-over-year demand in China increased 3.29% to 12.54 MMbpd.

Hurricane Sally is currently a strong category 1 hurricane with sustained winds of 90 mph. It is expected to make landfall on Wednesday between southeast Louisiana and the Florida Panhandle. Oil producers and refiners have shut down production ahead of the storm which has helped to lift prices.

In the IEA Oil Market Report for September, the IEA downgraded its 2020 crude demand forecast for the second time in as many months. The demand forecast dropped by 400 kbpd. OPEC also lowered its demand forecast for 2020. Both groups cited a slower than expected recovery from the pandemic. Other industry groups have suggested that there is a possibility that crude demand may have peaked in 2019.

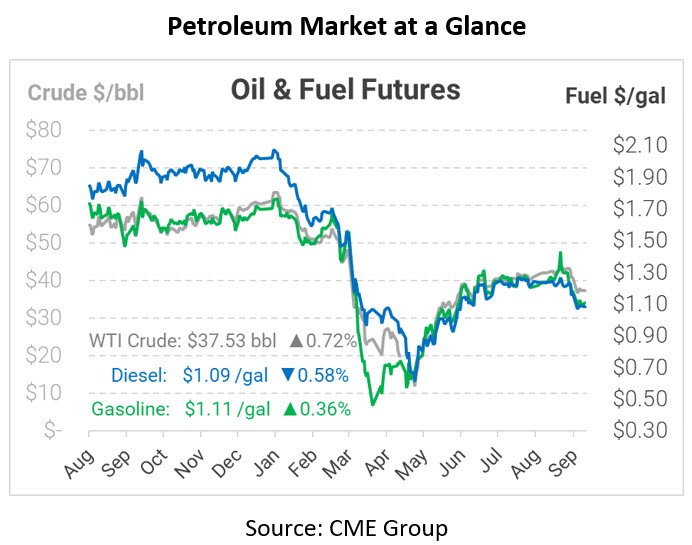

In early trading today, crude prices are up. Crude is currently trading at $37.53, a gain of 27 cents.

Fuel prices are mixed this morning. Diesel is trading at $1.0871, a loss of 0.6 cents. Gasoline is trading at $1.1108, a gain of 0.4 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.