4 Bearish Oil Factors – But Citi Still Forecasts $60 in 2021

With the global recovery stalling, oil markets remain under pressure this morning. A plummeting US Dollar gave oil markets a lift above $41 for a few weeks; however, the dollar is now slowly climbing from 2-year lows. Oil bulls have little to point to right now to justify a rally, leaving the bears to reign. And the bears have no shortage of ammo:

- Libya appears set to increase production by 1 MMbpd following months of conflict.

- The UEA, normally a compliant OPEC member with production capacity over 3.6 MMbpd, bucked the OPEC deal and pumped over 3 MMbpd in July and August (versus 2.6 MMbpd quotas).

- Last week, Saudis cut oil prices to Asian consumers.

- Global oil demand seems to be stuck around 92 MMbpd, compared to more than 100 MMbpd before the pandemic. Oil trading giant Trafigura now expects oil inventories to rise to end 2020.

Still, some voices maintain a more bullish outlook. Citigroup expects oil prices to hit $60/bbl in 2021, while averaging a lofty $48/bbl in Q4 2020. Their outlook hinges on a fast recovery of gasoline demand, even while jet fuel and diesel demand remain suppressed. Their outlook of $48/bbl oil in Q4 suggests a 40 cpg increase in fuel prices by the end of the year. If one thing’s certain right now – it’s how unclear the future for oil markets is.

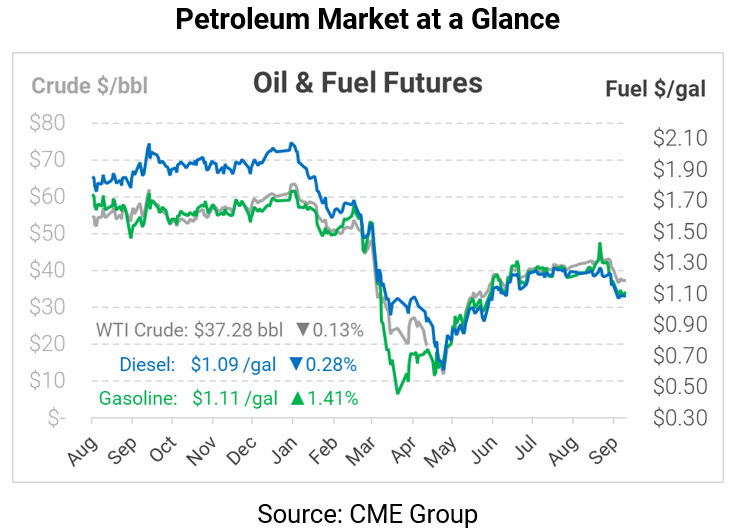

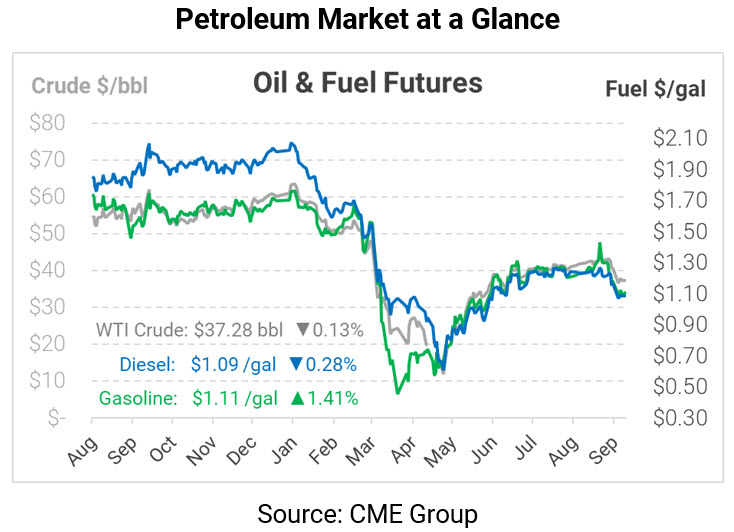

Crude oil is currently trading sideways, as markets weigh how much lower the downturn can go. WTI crude is currently $37.28, barely changed from Friday’s closing price.

Fuel prices are mixed. Like crude, diesel is trading sideways at $1.0865. Gasoline is a bit more active this morning, trading at $1.1103, up 1.5 cents.

This article is part of Daily Market News & Insights

Tagged: Bear, Citi, Inventories, Libya, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.