What If Hurricane Laura Had Been Worse?

Oil prices are trading sideways this morning on light headlines. With Hurricane Laura passed, oil companies are reopening offshore rigs, refineries, and fuel terminals, and so far all indications, fortunately, point to minimal damage. Peak hurricane season is just two weeks away (Sept 10), so markets will continue vigilantly tracking Atlantic conditions. Weather forecasters hinted at far worse results from Laura, but the storm’s path mitigated more severe impacts. With plenty more storms to come, it’s worth asking – what would have happened if Laura had severely impacted fuel markets, especially considering the rocky 2020 we’ve already experienced?

As we recently covered in FUELSNews 360, the storm’s strength is important but often less so than its path and its speed. Hurricane Harvey was only a Category 3 storm, but it moved slow and lingered directly on top of Houston’s refineries. Hurricane Laura was strong but delivered less than half the rainfall and sped past the coast in just a few hours. If Laura had moved slower, or targeted a major refining area, what would have happened?

Most years, the worst-case scenario for fuel markets would be prolonged refinery outages, such as what occurred in 2017 with Hurricane Harvey. Prolonged outages in the Gulf Coast ripple throughout the country, since Gulf Coast fuel feeds north to the Midwest and northeast up the East Coast. The impact is higher prices and tough logistics throughout the eastern half of the US.

Another tough scenario is a one-two combo, like Katrina-Rita or Harvey-Irma. The twin storms this week threatened a similar challenge, but Tropical Storm Marco quickly fizzled out. Hurricanes often require bringing in carrier capacity from outside markets to meet local demand. During Harvey-Irma, trucks drove from Florida to supply the Texas market, only to turn around and have to move product back to Florida days later. Twin storms can threaten both fuel supply and carrier capacity, causing severe strain on fuel supply chains.

Fortunately, nether of these two scenarios is particularly concerning in 2020. Due to COVID-19 shutdowns, fuel demand across the world has been dampened. Though significant recovery has taken place, much work is left. Diesel demand is roughly 15% below normal levels in the US, and gasoline demand is down roughly 10%. This spare capacity makes it easier for fuel suppliers and carriers to accommodate excess demand during a storm. High inventories also make refinery outages less worrisome.

Still, a hurricane could easily disrupt fuel supplies despite the overhang of fuel market capacity. Destruction of critical fuel infrastructure such as pipelines or fuel terminals would result in immediate supply outages. If the Colonial Pipeline fails, or a local fuel terminal sustained heavy damage, excess inventories would be inaccessible. While the fuel supply risks associated with hurricanes this season are reduced, there remain plenty of ways for hurricanes to disrupt fueling operations. As always, having a plan for managing emergency situations is critical to ensure normal operations as we approach peak hurricane season.

Today’s Market Prices

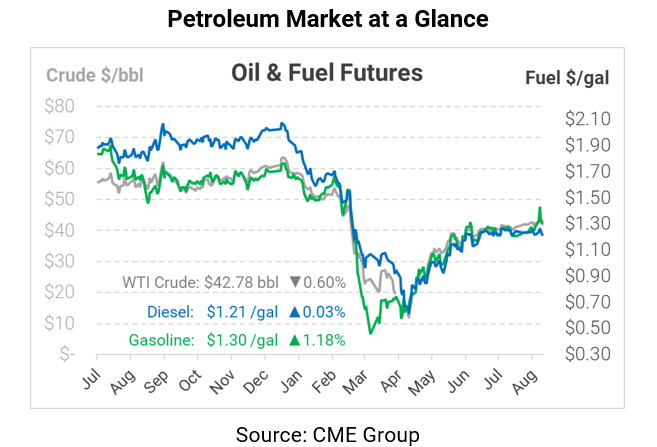

Crude oil is trading slightly lower this morning, giving up gains seen earlier in the week. WTI Crude is trading at $42.78, down 26 cents.

Fuel prices saw huge ups and downs this week, with large trading ranges for both gasoline and diesel caused by the hurricane. Diesel prices reached a high of $1.27 and a low of $1.20 this week, and currently is trading at 1.2111, flat with Thursday’s close. Gasoline gyrated between $1.44 and $1.27 (more than double diesel’s range), currently at $1.2997 with 1.5 cent gains.

This article is part of Daily Market News & Insights

Tagged: COVID-19, crude, diesel, gasoline, hurricane laura, Today’s Market Prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.