Twin Storms Target the Gulf Coast but Gains Capped by Coronavirus Fears

Yesterday, WTI crude closed slightly higher as the gulf coast prepares for two storm systems to hit this week. In Houston, on Monday prepeparations for the storms began in earnest, as the largest refinery in the US began the process of shutting down. Motiva Enterprises said shutting down their 607 Kbpd refinery in Port Arthur, TX could take several days. Meanwhile the twin storms continue to barrel towards the Gulf Coast. Upward price action has been muted by coronavirus worries.

In Hong Kong, the first case of human reinfection with the coronavirus has been documented. A man who had previously been infected and recovered four months ago was reinfected again recently. This calls into question claims of resistance built up after being sick and how long immunity to the virus may last.

In Europe, a recent spike in infections is a cause for concern. Per capita infection rates in Spain are higher than those in the US, but the US continues to lead the world in number of cases.

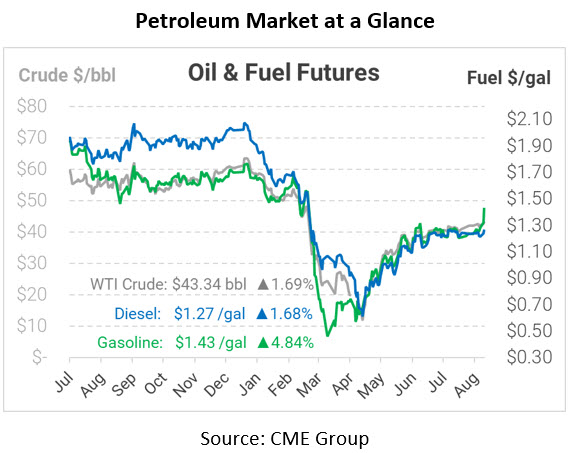

In early trading today, crude prices are up. Crude is currently trading at $43.34, a gain of 72 cents.

Fuel prices are up this morning. Diesel is trading at $1.2685, a gain of 2.1 cents. Gasoline is trading at $1.4332, a gain of 6.6 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, Gulf Coast, hurricane, Storm

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.