IEA Downgrades 2020 Demand Forecast

On Wednesday, WTI Crude closed higher on bullish inventory news confirmed by the EIA. Crude and products had draws with crude having a larger-than-expected draw and diesel posting surprise declines as well. WTI Crude is down in early trading this morning as gains from bullish inventory news are tempered by bearish news coming from the IEA.

The IEA Oil Market Report released its August report, stating: “Global oil demand is expected to be 91.9 mb/d in 2020, down 8.1 mb/d y-o-y. In this Report, we reduce our 2020 forecast by 140 kb/d, the first downgrade in several months, reflecting the stalling of mobility as the number of Covid-19 cases remains high, and weakness in the aviation sector.” In addition to demand concerns, the IEA points out that the supply of crude due to OPEC+ relaxing production cuts is a factor to be considered as the market tries to achieve balance this year.

The EIA reported a large decrease for crude of 4.5 MMbbls, versus an expected decrease of 2.9 MMbbls. At Cushing, the EIA reported that stocks rose by 1.3 MMbbls. US crude oil inventories are about 15% above the five-year average for this time of year. Distillates reported a surprise draw and continue to trend roughly 24% above the five-year average. Gasoline inventories fell in line with expectations and is about 8% above the five-year average.

The EIA also showed refinery utilization ticking up above 80% for the past week, which many interpreted as a sign of renewed faith in markets (or perhaps, a misguided attempt to restore normalcy). In a newsletter, OPIS pointed out that the figure was only made possible by removing the Philadelphia Energy Solutions (PES) refinery – which has been shut for over a year – from capacity numbers. The real week-over-week change was minimal, as refiners continue holding back product to restore market balance.

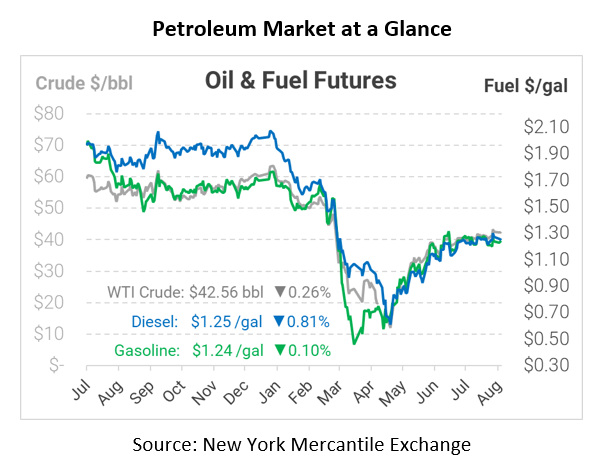

Crude prices are down this morning. WTI Crude is trading at $42.56, a loss of 11 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.2470, a loss of 1.0 cents. Gasoline is trading at $1.2426, a fractional loss.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.