US Dollar Provides Oil Tailwinds

Oil prices slid by $1.35 yesterday (-3.3%) after the US Commerce Department reported the largest single-quarter GDP drop in history: -32.9% on an annualized basis. The news was not a surprise (CNBC reports that markets were expecting a 34.7%) drop, but it still cast shadows over traders by highlighting just how dismal the economy has been. Germany also reported -10.1% GDP growth (annualized, that would be more than -40%).

The dismal economic news did have one silver lining, if you could call it that. The US Dollar, which has been sinking for the past few weeks, slipped to its lowest level since 2018. Global traders seek high returns wherever they may occur. Weak growth in the US causes traders to cash in their US investments and convert their currencies to, for example, yen so that they can invest in the Japanese Nikkei.

The USD Index, measured against a basket of its international peers, is an important factor for commodities. There is a loose negative correlation between the dollar and commodities, though the relationship is not direct. When the dollar falls, commodities prices in USD become cheaper for other countries, increasing demand for products and giving prices a boost. The dollar’s recent decline supported oil prices above $41/bbl for the last two weeks, but economic pressures have finally overwhelmed the tailwinds to push prices lower.

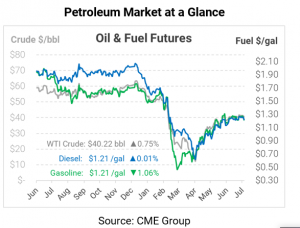

After a steep drop on Thursday, oil prices are recovering some of their losses, though gasoline remains weak. WTI crude is currently trading at $40.22, up 30 cents.

Fuel prices are mixed. Diesel prices are trading at $1.2120, unchanged from Thursday’s close. Gasoline is a bit trickier. The product is currently trading at $1.2075, down 1.3 cents. Gasoline prics go through major seasonal changes as summer-spec requirements come and go. Today is the last trading day for the August futures contract; Monday will see prices roll to September futures. The Sept RBOB contract is currently trading around 3 cents lower than August, and October is 10 cents lower. The differentials run like clockwork each season, highlighting that cheaper gas prices lie ahead.

This article is part of Daily Market News & Insights

Tagged: Commodities, crude oil, Economy, GDP, US Dollar

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.