Week in Review – July 24, 2020

Oil markets have seen relatively small movements this week, as little news has crept in to propel markets one way or another. Early in the week, the EU announced a historic decision to issue collective debt on behalf of its member nations – something the union has been hesitant to do in the past. While this decision is groundbreaking for bond markets, its financial implications could be years in the future, and likely won’t directly impact commodity markets. Crude prices received an initial bump, but that proved temporary.

This week also brought continued hope for economic recovery. Although US unemployment ticked up for the first time since March, markets gained confidence that a resolution could be forthcoming. Promising vaccine candidates are making progress in clinical trials, and the US government has begun placing bets by signing contracts to buy 100 million vaccines this year.

Midweek, the EIA reported a slightly bearish inventory report, reminding markets that long-term hope do not trump short-term concerns. Crude inventories built by 4.9 million barrels, and diesel stocks grew as well. The one glimmer of good news was gasoline stocks, which posted a larger-than-expected -1.8 MMbbl draw.

Ending the week, prices are flat as oil traders watch the approaching storms in the Gulf of Mexico. Storms cause a variety of oil market impacts, increasing demand before the storm hits and at times damaging fuel infrastructure. Time will tell how Tropical Storms Hanna and Gonzalo will impact fuel markets.

Prices in Review

Crude prices began the week at $40.64, sinking on Monday before regaining its strength. News of the EU debt issuance gave all markets a huge boost, causing prices to soar above $42/bbl on Tuesday before settling just below that level. The EIA’s inventory report put a dent in the rally, but prices soared once again on Thursday. Crude oil opened Friday at $41.06, marking an overall weekly gain of 42 cents or 1.0%.

Diesel prices demonstrated results comparable to crude oil, beginning the week low but rallying higher as the entire market lifted higher. Starting the week at $1.2198, prices climbed as high as $1.29, shrinking back to $1.2576 for Friday’s opening price. Overall, markets gained 3.8 cents, up 3.1%.

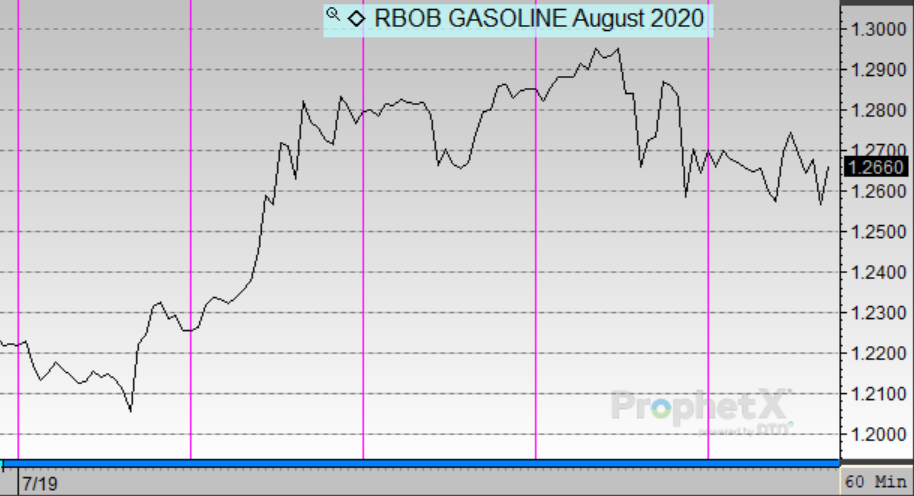

Gasoline opened the week at $1.2245. After rising on Tuesday, gasoline prices became susceptible to the bearish EIA report despite the surprisingly large draw. On Friday, gasoline opened at $1.2630, showing gains of 3.9 cents (3.1%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.