Fuel Demand Anywhere Affects Prices Everywhere

After hitting a four-month high earlier this week, oil markets are dropping again following worldwide reports of sinking demand. In the US, gasoline demand has slowly climbed back to near-normal, but improvements have decelerated. In areas with low infection rate, demand has roughly normalized, meaning further gains won’t come until high-infection areas can also reopen.

The US isn’t the only country experiencing demand issues. India is seeing demand shrink as well, which Reuters attributes both to rising retail fuel prices as well as lockdowns in parts of the country. Diesel demand accounts for 40% of India’s total fuel needs and fell 18% in the first few weeks of July. Despite collapsing oil prices, India’s fuel rates hit a record high last month as the government raised fuel taxes and national oil companies hiked their margin. With global commodities like oil, demand in one area of the country – especially one with as many consumers as India – can create global price effects.

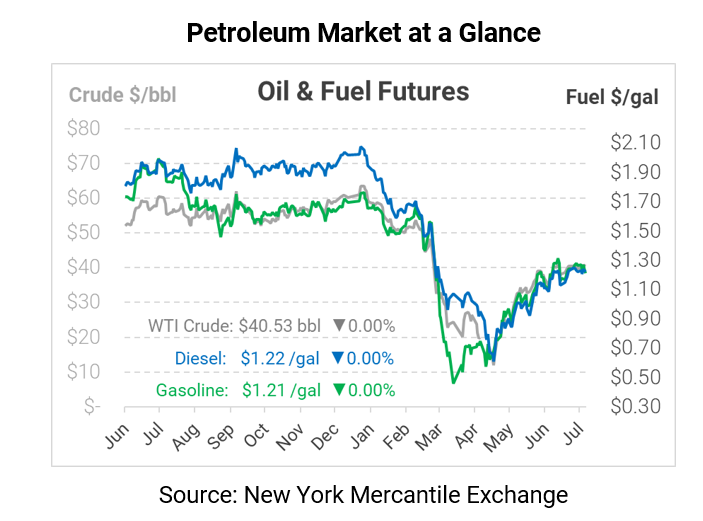

Oil prices are falling gently this morning, sustaining Thursday’s losses. Crude oil is trading at $40.53, down 22 cents from Thursday’s close.

Fuel prices are also sinking, with gasoline leading the way. Gasoline prices are trading at $1.2138, down 2 cents since yesterday. Diesel prices are currently $1.2215, pulling slightly ahead of gasoline after prices fell just 0.6 cents.

This article is part of Daily Market News & Insights

Tagged: COVID-19, diesel, fuel-demand, India

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.