OPEC+ to Discuss Plans Today

On Tuesday, WTI Crude closed relatively flat, but is moving higher this morning on bullish inventory news from the API. The API reported crude inventories fell by 8.32 MMbbls last week. The EIA this morning only confirmed a draw of 7.5 MMbbls in crude. The large draw would seem to indicate that the supply glut is easing as demand begins to return.

OPEC+ is meeting today to discuss whether to ease the current historic production cuts of 9.7 MMbbls per day in August. The original plan was to ease cuts to 7.7 MMbbls per day from August to December, but a final decision on the matter has not been made. There are reports that OPEC+ is seeking extra production cuts from members that had been missing their targets in June. This would temper the impact of the wider cartel resuming additional production next month. Iraq, Nigeria, and Kazakhstan are being asked to make an additional 842 kbpd cut in August and September to compensate for missed production cut targets earlier in the year. Assuming those incremental cuts are achieved, the net result would be another 50 million barrels taken off the market over two months.

The EIA reported a decrease for crude of 7.5 MMbbls, versus an expected decrease of 2.1 MMbbls. At Cushing, the EIA reported that stocks rose by 1.0 MMbbls. US crude oil inventories are about 17% above the five-year average for this time of year. Distillates reported a surprise draw and trends roughly 26% above the five-year average – more on this surprise draw in tomorrow’s FUELSNews. Gasoline reported a draw in stocks and is about 7% above the five-year average.

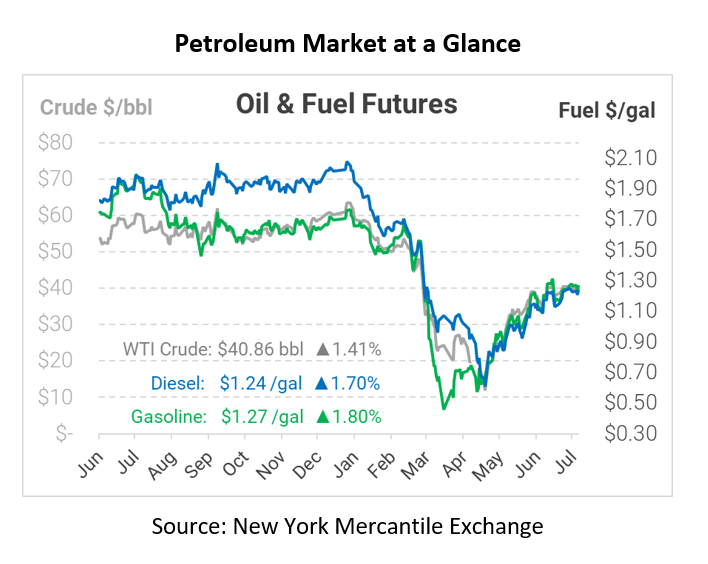

Crude prices are up this morning. WTI Crude is trading at $40.86, a gain of 57 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.2416, a gain of 2.1 cents. Gasoline is trading at $1.2699, a gain of 2.3 cents.

This article is part of Daily Market News & Insights

Tagged: API, inventory, opec, production, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.