IEA Raises Demand Forecast, Warns of Downside Risk

Yesterday brought a sharp break from the oil market’s earlier stability. Crude prices shed over $1/bbl as several companies, including Wells Fargo and United Airlines, announced employee layoffs following a dismal jobs report. Unemployment claims have fallen precipitously from their March peak but remain double the highs of the 2008-09 recession. Rising coronavirus cases in the US threaten to extend the economic malaise by undoing attempts to re-open states.

Following other oil forecasts earlier this week, the IEA published their monthly Oil Market Report, which begins by pointing out that global oil supply fell to 86.9 MMbpd, a 9-year low, in June. The agency raised its demand forecast for the year, in part because, “the [demand] decline in 2Q20 was less severe than expected.” Next year, demand will be just 2.6 MMbpd below 2019 levels, almost entirely due to weakened jet fuel and kerosene demand. If that’s true, it may put long-term downward pressure on diesel prices as more jet fuel finds its way into diesel streams coming from refiners.

Despite the optimistic forecast, the IEA did end on a very gloomy note: While the oil market has undoubtedly made progress since ‘Black April’, the large, and in some countries, accelerating number of Covid-19 cases is a disturbing reminder that the pandemic is not under control and the risk to our market outlook is almost certainly to the downside.

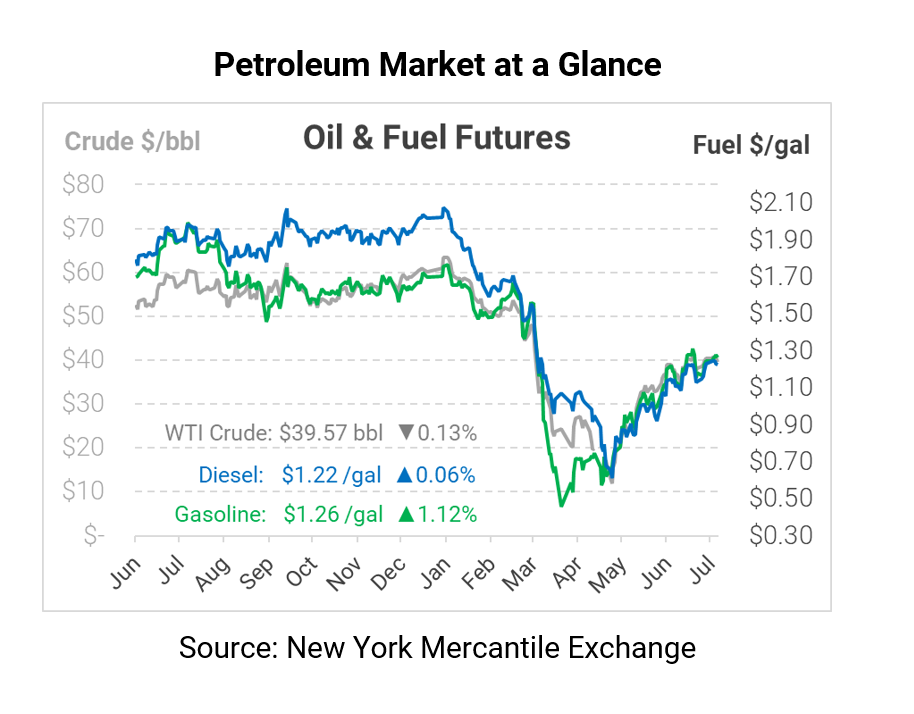

Crude oil has returned to its calm state after yesterday’s hiccup. Crude oil is trading at $39.57 this morning, just 5 cents off from yesterday’s closing price.

Fuel prices are mixed. Diesel prices are unchanged as well, trading at $1.2246 after shedding merely a penny yesterday. Gasoline prices, which hurdled four cents lower yesterday, are trading at $1.2645, up 1.4 cents.

This article is part of Daily Market News & Insights

Tagged: crude, fuel prices, IEA, Oil Market Report, United Airlines, Wells Fargo

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.