Large Crude Draw, Climbing Fuel Demand Bolsters Market

FUELSNews will resume normal publications on July 6. Happy Independence Day!

Oil prices are back above $40/bbl following a bullish EIA report yesterday and positive trends around the country. Despite some brimming rumors of a renewed Saudi price war due to non-compliance of a few smaller OPEC countries, the group posted its lowest month of production since 1991 according to one survey. Between low OPEC output, shrinking US production, and climbing fuel demand, oil prices are inching their way higher. After months of 5-10% price swings each day, the market is slowly gaining ground with small 1-2% gains.

The EIA released its weekly inventory report yesterday, which aligned with the API’s crude inventory numbers but sharply contradicted in refined product levels. Crude stocks fell by 7.2 MMbbls last week due both to higher refinery throughput and to declining imports in the Gulf Coast, especially from Saudi Arabia. Inventories around the world are also moving lower, with floating storage (stocks held temporarily in crude tankers) slowly unwinding from a peak of 180 million barrels.

Gasoline demand held roughly steady with only a small dip week-over-week, but fears are building that returning demand may have hit a wall. The approaching holiday weekend will be a crucial test for the markets – US consumers typically hit the roads in droves to celebrate Independence Day. If next week’s gasoline consumption remains weak, expect a bearish market disposition.

Diesel inventories posted a small draw, leaving stocks nearly 40 million barrels above the five-year average level. Still, inventories have stopped their ascent and begun to slowly turn lower.

As gasoline demand picks up and refiners go back to normal yields of diesel fuel, markets may have more luck chewing through existing inventories. Diesel demand was only slightly off from levels the same week one year ago, suggesting that the economy is trucking along (pun intended) fairly well.

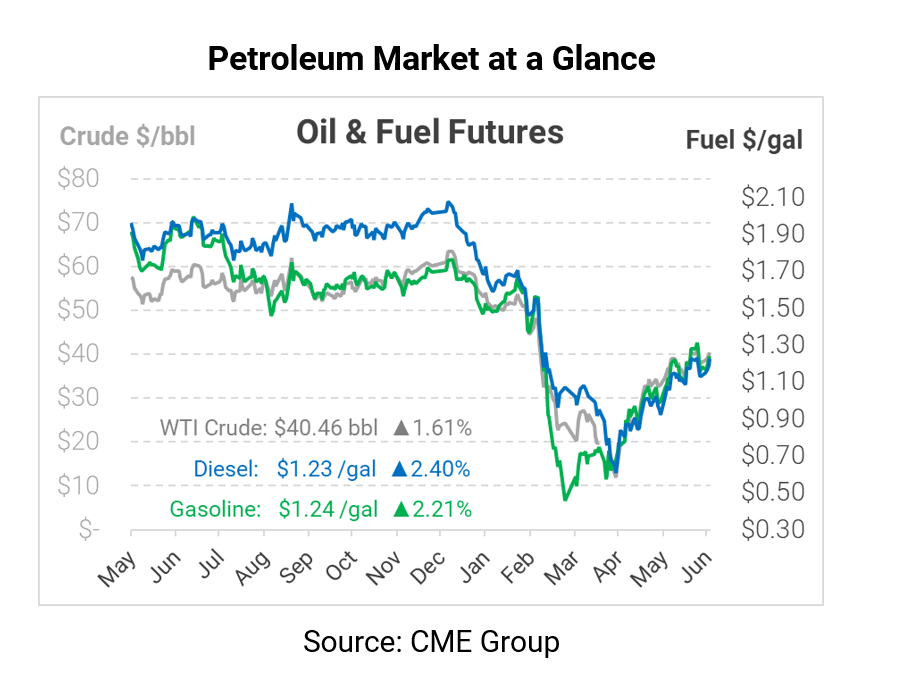

Crude oil prices are once again above $40/bbl after a week of sub-$40 closes. All bets are off on whether those prices hold heading into this afternoon. Crude oil is currently trading at $40.46, up 64 cents (+1.6%) from Wednesday’s closing price.

Fuel prices are rising even faster this morning. Diesel is trading at $1.2284, up 2.9 cents (+2.4%) from yesterday and closing the gap with gasoline prices. Gasoline is trading at $1.2438, up 2.7 cents (+2.2%).

This article is part of Daily Market News & Insights

Tagged: diesel, eia, gasoline, Inventories

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.