Natural Gas News – June 4, 2020

Is This The Next Major Market For U.S. LNG?

Natural gas producers have had little to cheer about over the past few months after prices sunk to multi-year lows amid a huge oversupply and warm

weather. The slowdown could not have come at a worse time for the burgeoning U.S. LNG industry, which has experienced explosive growth over the past decade that put the nation on the cusp of becoming the world’s largest LNG exporter ahead of Qatar and Australia. But now, U.S. LNG producers can afford to smile after nabbing a key customer: Turkey. Turkey’s LNG imports from the U.S. tripled during the first quarter to nearly a million tons (48 billion cubic feet of natural gas) as Ankara continued to distance itself from Russian and Iranian natural gas. For more on this story visit oilwatch.com or click https://bit.ly/3dvzMjx

Are Natural Gas Prices in a ‘Buy’ Zone Right Now?

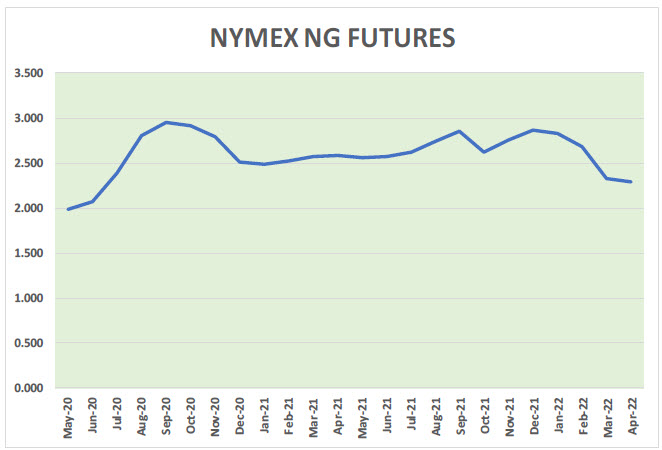

Last week, natural gas active futures rose 6.8% and settled at $1.849 per MMBtu—the largest weekly gain since the week ended April 10. The US summer season started at the beginning of June. Usually, the demand for natural gas rises for cooling purposes. Natural gas prices could see a large upside in the coming months. Will natural gas prices rise this summer or remain range-bound? Inventories spread During this period last year, the natural gas inventories spread was at -16.4%. For the week ended May 22, the natural gas inventories spread was at 19.3%. For more on this story visit marketrealist.com or click https://bit.ly/2U695u8

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.