Cheating Dashes Hopes of Early OPEC+ Meeting in Doubt

On Tuesday, WTI Crude jumped higher on news that Saudi Arabia and Russia reached a preliminary agreement to extend the current supply quotas for another month before tapering back cuts. A bullish API inventory report also helped to lift markets. Crude is down in trading this morning after yesterday brought prices to their highest levels since March.

Although some members sought an early OPEC+ meeting to review cut extensions, that meeting is now being doubted due to cheating on supply quotas by some cartel members. Bloomberg reported Thursday’s meeting is unlikely unless OPEC+ resolves compliance problems. A production cut extension had been priced into the market already, so this pessimistic news is putting downward pressure on markets.

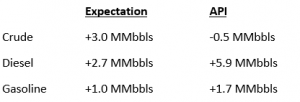

The API’s data last night:

The API reported a surprise draw for crude of 0.5 MMbbls versus an expected build of 3.0 MMbbls. At Cushing, stocks drew by 2.2 MMbbls. The API reported that both gasoline and distillates had a larger-than-expected increase. The EIA will report numbers later this morning.

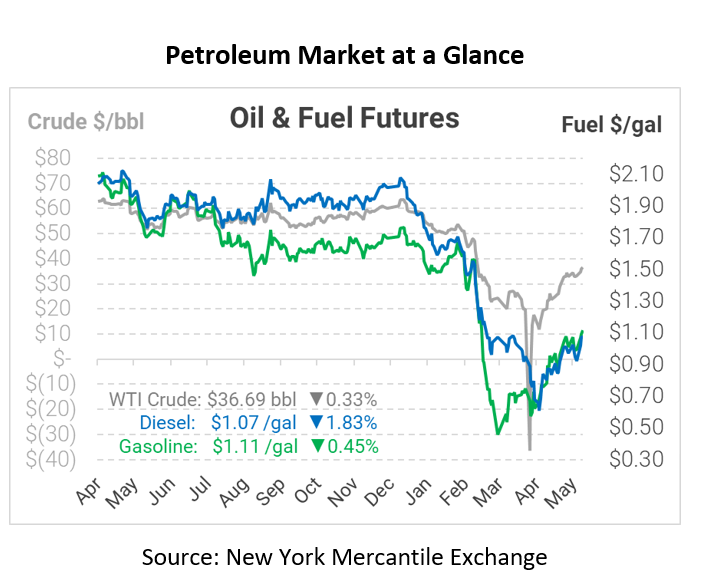

Crude prices are down this morning. WTI Crude is trading at $36.69, a loss of 12 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.0721, a loss of 2.0 cents. Gasoline is trading at $1.1133, a loss of 0.5 cents.

This article is part of Daily Market News & Insights

Tagged: API, Draw, opec, Russia, Saudi Arabia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.