Russia Calls OPEC+ Supply Cuts a Success

On Wednesday, WTI Crude finished sharply lower on the news from Russia stating that they wish to increase production in July in accordance with the original OPEC+ plans for tapering off production cuts. In early trading today, prices are flat, but API inventory news of a surprise build in crude is putting downward pressure on prices.

Talks between Russia’s President Vladimir Putin and Saudi Crown Prince Mohammed Bin Salman have centered around coordinating OPEC+ supply cuts to balance the market. Russia feels cuts so far have been a huge success, and production should be brought back online in July as had been agreed upon in the original plan for recent cuts. OPEC+ will hold online meetings on June 9-10 to discuss if they should extend the current supply cuts or begin tapering them off as Russia wants.

Data seem to support that demand is returning for products. Memorial Day weekend travel data showed that many people have returned to automobile travel. Airline travel is also seeing a recent uptick in demand. Personal travel is beginning to show a return to normalcy in the US and abroad. While demand gains have been modest, the market sentiment is optimistic.

The API’s data last night:

The API reported a surprise build for crude of 8.7 MMbbls versus an expected draw of 1.9 MMbbls. At Cushing, stocks drew by 3.4 MMbbls. The API reported that both distillates and gasoline had a larger-than-expected increase. The EIA will report numbers later this morning.

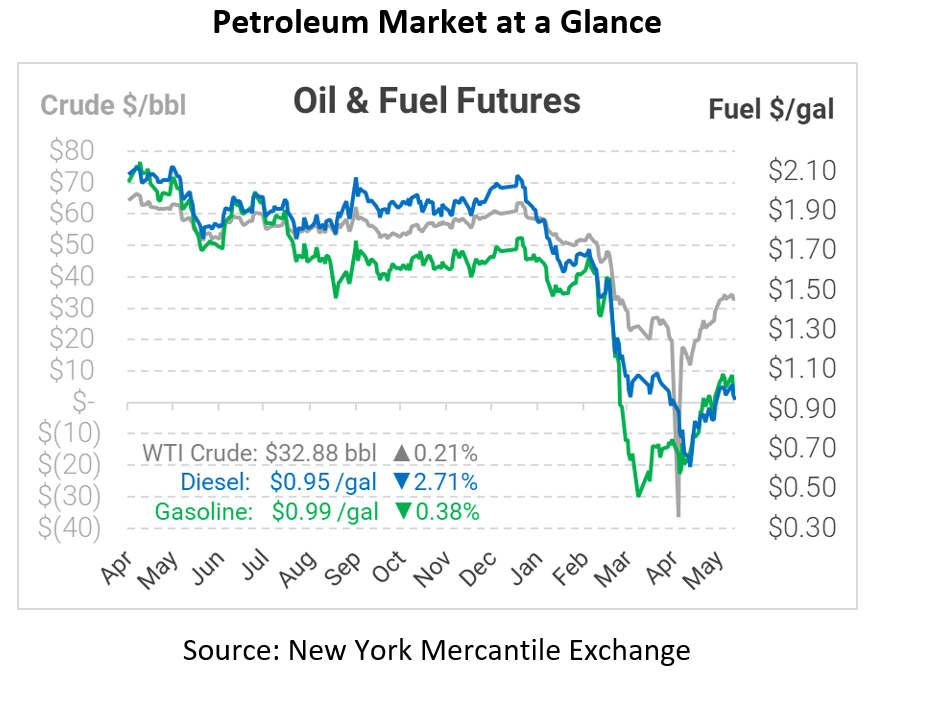

Crude prices are flat this morning. WTI Crude is trading at $32.88, a gain of 7 cents.

Fuel is down in early trading this morning. Diesel is trading at $0.9458, a loss of 2.6 cents. Gasoline is trading at $0.9895, a fractional loss.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.