Oil Demand Could Exceed Pre-Crisis Levels

Coming off a long weekend, oil is climbing to fresh highs this morning as positive sentiment endures. The market continues with the mantra “no news is good news” – another day without a major uptick in COVID-19 cases and no unexpectedly low economic data constitutes a win.

The IEA’s Executive Director commented this weekend that low oil prices could drive demand even higher than pre-crisis levels, though that return will take time. Many have speculated whether COVID-19 will send oil demand into a permanent decline as tele-working and travel restrictions become the norm. But a few employees working remote will be more than offset by economic growth in developing economies, where millions could rise from poverty and purchase cars of their own. The IEA still forecasts oil demand rising to 105 MMbpd by 2030 and slowly climbing from there to reach a peak in 2040.

On the supply side, Russia has reportedly achieved its production cut goals of 2 MMbpd, according to Russia’s Energy Minister Alexander Novak. The country expects global markets to balance by June or July, given global production cuts of roughly 15 MMbpd. US rig counts continue falling, declining last week by 21 rigs to reach a new low of 237 total rigs deployed. Typically, crude prices in the $30/bbl range is enough to incentivize a revival in shale production, but the pricing meltdown and financial constraints have so far slowed US producers from rushing back to oil fields.

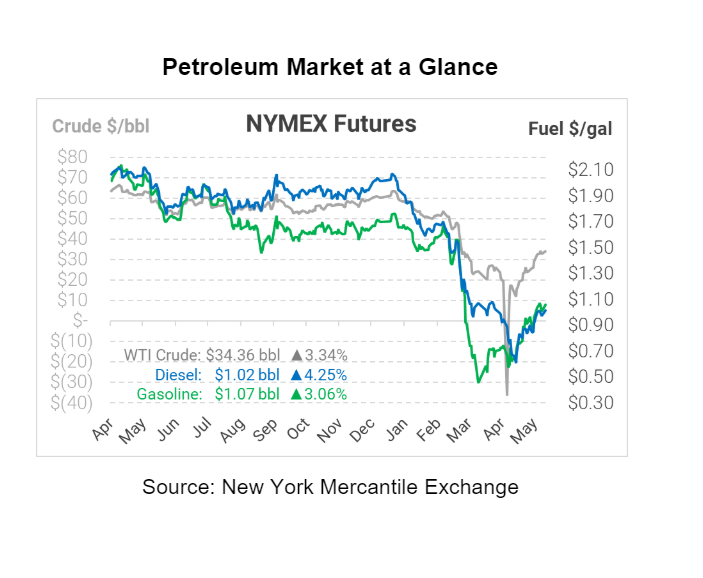

Crude oil prices are currently trading at their highest level since early March. WTI crude is $34.36, up $1.11/bbl from Friday’s closing price.

Fuel prices are also posting hefty gains, with both gasoline and diesel trading above $1/gal once again. Diesel prices are currently $1.0237, up 4.2 cents from Friday’s close. Gasoline prices are trading at $1.0700, up 3.2 cents.

This article is part of Daily Market News & Insights

Tagged: COVID-19, IEA, oil demand, opec, US production

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.