Week in Review – May 22, 2020

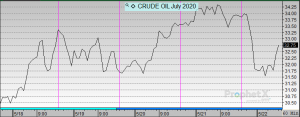

WTI crude closed yesterday near 10 week highs but prices finished off the day’s highs due to profit taking and concerns about demand recovery. It has been a strong month for crude with the June contract expiring in the black – a far cry from the negative prices seen in May. This month experienced the benefit of the OPEC+ supply cuts and the shut-ins of US production. As prices continue rising, there is some concern that US production may come back online and disturb the tenuous market balance that has lifted prices this past month.

Concern about US relations with China, and China’s recovery from the pandemic, are putting downward pressure on markets this morning. The market is giving back some of the gains earned throughout the week in early trading this morning.

Prices in Review

WTI Crude opened the week at $29.53. It followed a generally upward track throughout the week to close the week higher. Crude opened Friday at $33.95, a gain of $4.42 (15.0%).

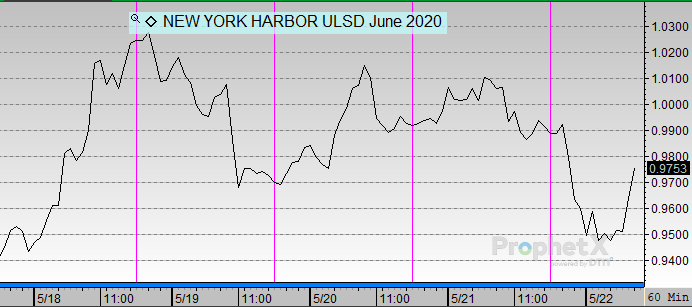

Diesel opened the week at $0.9205. It had a choppy week of ups and downs to close the week higher. Diesel opened Friday at $0.9873, a gain of 6.7 cents (7.3%).

Gasoline opened the week at $0.9700. It had a slight bump up to start the week and then was mostly flat to close out the week higher. Gasoline opened Friday at $1.0450, a gain of 7.5 cents (7.7%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.