Markets Fall as China Abandons GDP Forecast

The oil complex is pulling back this morning after posting sizable gains throughout the week. Heading into a long weekend, traders are taking their gains and exiting the market. Uncertainty regarding updates in China is also leading the market to take a cautious approach.

The Chinese economy, once the centerpiece of the COVID-19 debacle, is now back in focus, with Beijing abandoning its GDP forecast for 2020 while unveiling a $500 billion stimulus program. Official data shows the Chinese economy contracting by -6.8% in Q1 2020, the first official decline reported since 1976. Last year, Chinese GDP growth was 6.1%, its slowest growth in almost thirty years.

Adding to concerns, US-China tensions continue flaring. The US this week passed legislation preventing Chinese companies from listing on US stock exchanges unless they comply with US regulatory requirements. The bill also requires companies to declare they are not “owned or controlled by a foreign government.” The move is expected to drive Chinese companies to list on other exchanges such as Hong Kong’s Hang Seng index.

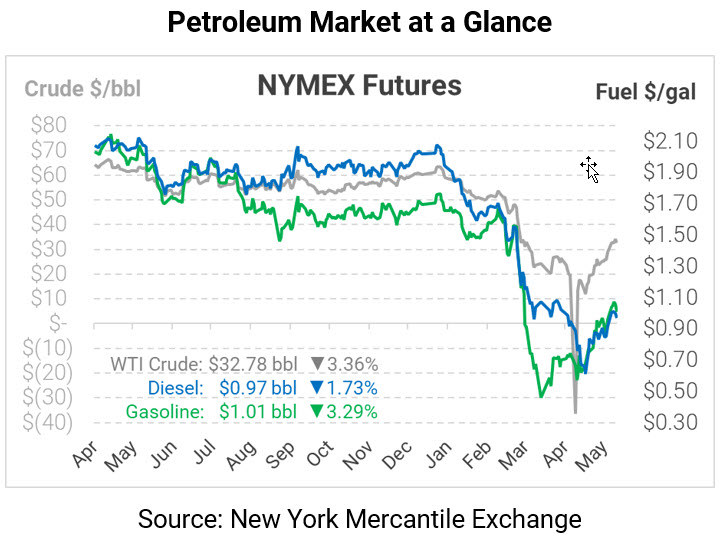

Crude oil prices are falling this morning, bringing the 6-day uptrend to a close. WTI Crude is currently trading at $32.78, down $1.14 per barrel from Thursday’s closing price.

Fuel prices are also retreating from this week’s gains. Diesel prices are back below the $1/gal mark, falling 1.7 cents to trade at $0.9719. Gasoline prices are currently trading at $1.0107, down 3.4 from Thursday’s close.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.