Fed Chairman States – Don’t Bet Against America

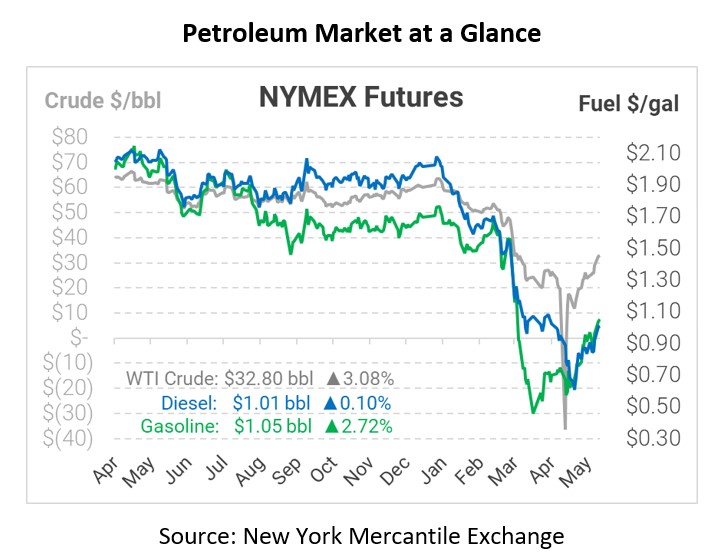

Yesterday, WTI crude broke into the $30 price range for the first time since the 1st quarter of this year. Prices are continuing their upward trend in early trading this morning. The negative prices of last month seem like a distant memory as the June contract prepares to expire while holding onto gains. Several factors are helping to drive this rally including rising demand and deepening supply cuts. In addition, optimism around getting closer to finding a vaccine for the coronavirus and a rise in equities spurred by recent positive economic sentiment from the chairman of the Fed have helped to lift markets.

Federal Reserve Chairman Jerome Powell stated in a recent interview that this sharp economic downturn may last a year and a half but will not turn into another Great Depression. The Great Depression was caused by underlying problems with the economy and financial system. The current downturn does not have those underlying factors. The economy and financial system were strong and robust before the coronavirus forced the world into quarantine. “In the long run, and even in the medium run, you wouldn’t want to bet against the American economy,” Powell said.

In early trading today, crude prices are up. Crude is currently trading at $32.80, a gain of 98 cents.

Fuel prices are up this morning. Diesel is trading at $1.0074, a fractional gain. Gasoline is trading at $1.0537, a gain of 2.8 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, demand, Fed, Jerome Powell, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.