Gasoline’s Strength Meets Quick End

As April came to a close, fuel prices reversed their position. Since last Friday, gasoline prices have been trading at a premium to diesel fuel, but yesterday traders decided that gasoline may not be all it’s cracked up to be. As the May 2020 contract expired, diesel picked up 4 cents, while gasoline posted 3 cent losses. Coming after a strong draw in gasoline inventories, the reversal is surprising – but it’s worth remembering that gasoline is falling from record-high stocks, while diesel just recently surpassed the 5-year average. So perhaps last week’s brief return to normalcy, with summer gasoline more expensive than diesel, was never meant to last.

In other fuel trend news, 3:2:1 crack spreads are beginning to inch their way back to normal, which contributed to the 2% uptick in refinery utilization this past week. Over the last few years, 3:2:1 crack spreads, which roughly represents a refiner’s margin for converting crude into gasoline and diesel, have trended between $10 and $25 per barrel, with brief exceptions. From mid-March through mid-April, spreads averaged just $8.65. But over the last two weeks, those spreads have climbed back to averaging $13.31 – still low, but within a more normal range. High gasoline prices are twice as important as diesel prices in crack spreads, so this past week’s gasoline gains have helped refiners maintain throughput. With gasoline sinking again, refiners go back to feeling the market’s pain in the coming week, resulting in less fuel inventories.

Crude oil is getting support from US attempts to expand storage. Treasury Secretary Steven Mnuchin is evaluating methods to add hundreds of millions of barrels to the United States’ Strategic Petroleum Reserve capacity, which would give producers a place to put all their unwanted crude oil. More importantly, demand is beginning to tick higher around the world, with Chinese drivers hitting the roads en mass and contributing to higher traffic that this time last year.

Today’s Prices

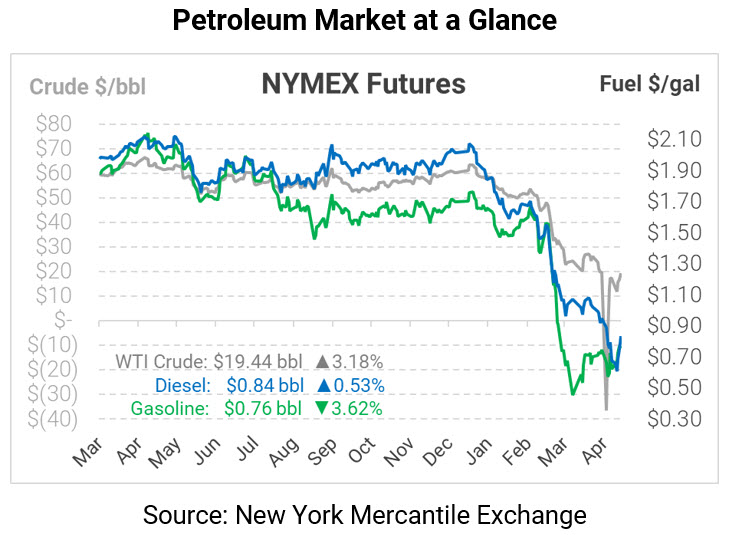

Oil prices are lightly higher this morning, buoyed by positive demand trends and support from central banks worldwide to stem the tide of economic losses. Crude oil is trading at $19.44, up 60 cents (3.2%).

Fuel prices are mixed, with diesel ekeing out small gains while gasoline weakens. Diesel is trading at $0.8375, up 0.4 cents (0.5%). Gasoline is trading at $0.7553, down 2.8 cents (-3.6%) from Thursday’s close.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.