Crude Drops to 18-Year Low

Yesterday, crude dropped to 18-year lows on bearish demand news from the IEA and on bearish inventory news from the EIA. WTI & ULSD futures extended their losses after the IEA forecasted a record 29 million bpd decline in global oil demand due to the COVID-19 pandemic quarantine efforts. The EIA also reported a record weekly build in US inventories of 19.2 MMbbls for last week. Crude price are up slightly this morning on the potential that the US may intervene with supply cuts to help prop up crude prices.

The Trump administration is contemplating taking action to alleviate the crude supply glut that has caused prices to fall and has caused some US oil companies to declare bankruptcy. The US Department of Energy has drafted a plan to pay US oil producers to leave crude in the ground. They plan to use the untapped crude, as much as 365 MMbbls worth of oil reserves, as part of the US government’s emergency stockpile. (Reuters)

On April 21, the Texas Railroad Commission will meet to discuss the possibility of cutting oil supply to help relieve the supply glut and to support crude prices. This action, independent of OPEC+ and its allies, would need the support of two of the three commissioners to pass. (Bloomberg)

The EIA reported a larger-than-expected build for crude of 19.2 MMbbls, versus an expected build of 11.7 MMbbls. At Cushing, the EIA reported a 5.7 MMbbls build. At 503.6 million barrels, U.S. crude oil inventories are about 6% above the five-year average for this time of year. Distillates reported a larger-than-expected build. Gasoline reported a smaller-than-expected build.

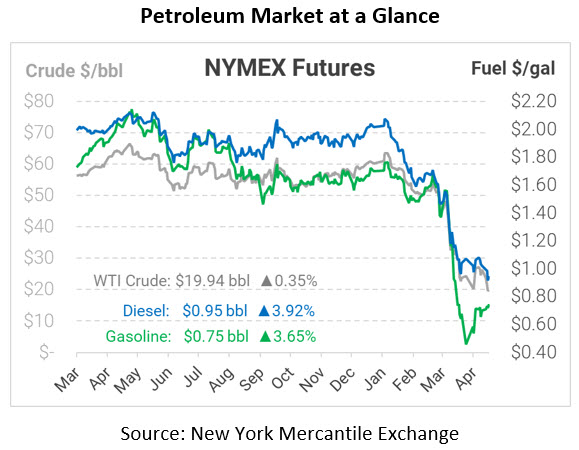

WTI Crude is trading slightly higher this morning at $19.94, a gain of 7 cents..

Fuel is up in early trading this morning. Diesel is trading at $0.9496, a gain of 3.6 cents. Gasoline is trading at $0.7467, a gain of 2.6 cents.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.