Trump Threatens Oil Tariffs

Yesterday, crude followed equities higher to start the day, but then ended lower as did equities on general pessimistic coronavirus sentiment. Crude is trading higher this morning on the hopes that OPEC+ will come to some supply cut agreement as they meet tomorrow. Expectations are for the largest supply cut ever agreed to by the Cartel. Russia and Saudi Arabia are hoping other countries including the US, Brazil, and Norway will make also make supply cuts to lessen the burden on OPEC.

President Trump has stated that he may be willing to use tariffs on oil imports to help protect US oil interests, but some have questioned the effectiveness of tariffs to do so. US Senators plan to speak with Saudi officials after the Thursday OPEC + meeting in hopes that some amicable agreement can be reached.

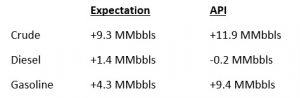

The API’s data last night:

The API reported a larger-than-expected build for crude of 11.9 MMbbls versus an expected build of 9.3 MMbbls. At Cushing, stocks rose with a build of 6.8 MMbbls. The API reported that gasoline had a larger-than-expected build and distillates had a small surprise draw. The EIA will report numbers later this morning.

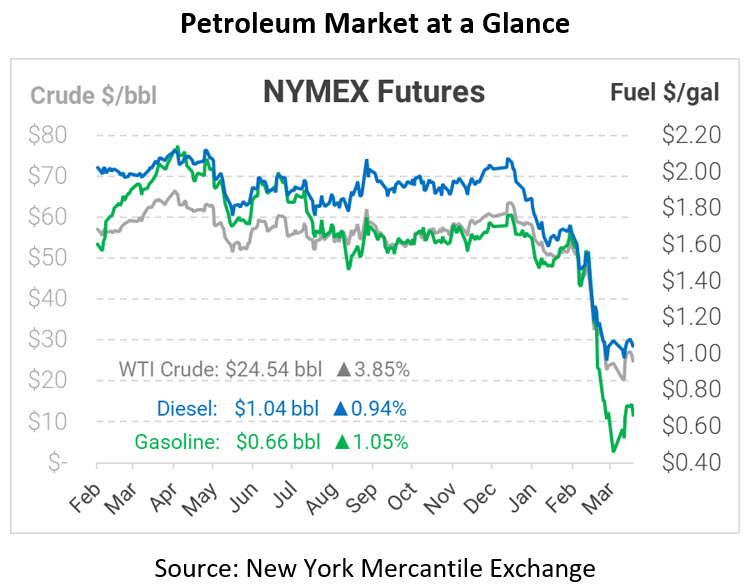

Crude prices are down this morning. WTI Crude is trading at $24.54, a gain of 91 cents.

Fuel is up slightly in early trading this morning. Diesel is trading at $1.0372, a gain of 1 cent. Gasoline is trading at $0.6550, a gain of 0.7 cents.

This article is part of Coronavirus

Tagged: and Norway, Brazil, Cartel, opec, President Trump, Russia and Saudi Arabia, US, US oil

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.