Goldman Sachs Slashes Brent Target to $20

Yesterday, crude prices fell over 10% as markets considered how to account for the demand destruction caused by the coronavirus. Both WTI and Brent crude fell below $30/bbl yesterday – to the lowest level in four years. Equities also dropped more than 10% yesterday in a round of panic selling touched off by the Fed’s emergency rate cut. The rate cut, bringing rates near zero, were intended to energize markets but had the opposite effect.

According to Goldman Sachs Research, commitments from OPEC for April/May deliveries puts the net supply increase to nearly 3 mmbpd. This increase combined with demand losses results in an April/May surplus of 7 mmbpd. Based on these numbers, Goldman Sachs lowered their 2Q Brent to $20/bbl from $30/bbl. Saudi Aramco has said it is likely to carry over its planned higher oil output for April into May and that it is “very comfortable” with an oil price of $30/bbl. (Reuters) How long would the Saudis tolerate $20/bbl?

In other news, San Francisco Bay area officials ordered nearly 7 million people to ‘shelter in place’ to curb the spread of the coronavirus. People will be required to stay home except for essential needs. While the order will close businesses across the region, essential businesses like grocery stores and pharmacies will remain in operation. The order will not strictly confine people to their homes. If people need to be out, social distancing of six feet apart would be followed. Officials added that restaurants will remain open for delivery and takeout.

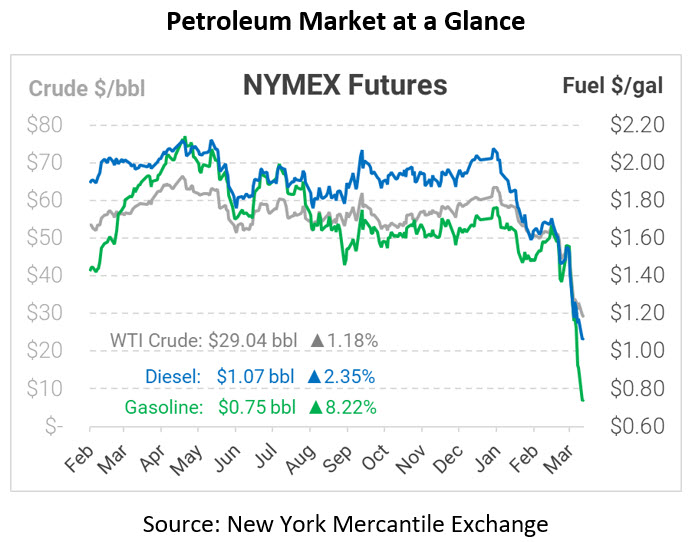

In trading today, crude prices are rebounding slightly from yesterday’s drop. Crude is currently trading at $29.04, a gain of 34 cents.

Fuel prices are also up today. Diesel is trading at $1.0712, a gain of 2.5 cents. Gasoline is trading at $0.7466, a gain of 5.7 cents.

This article is part of COVID-19

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.