Fed Announces Emergency Rate Cut to Near-0%

Markets are continuing to take a beating this morning, following an emergency Federal Reserve interest rate cut over the weekend which sent a new wave of jitters to investors. Having already cut rates by 0.5% two weeks ago, the Fed this weekend slashed rates by another 1%, bringing them to essentially zero. The cut represents the steepest action the Fed has taken since 2008, the last time it took rates to 0%. While the move will help provide liquidity to a tightening market, markets appear anxious that the Fed has now fired the last bullet in its arsenal to stave off a recession.

For oil prices, lower interest rates typically cause the US Dollar to fall in value, in turn sending oil prices higher. Lower interest rates would also typically cause the stock market to rise. However, the emergency action seems to have sent the reverse signal, leading all markets lower.

Along with the emergency rate cut, on Friday President Trump announced a litany of policies to help stem the tide of economic losses. Among them, he announced that the federal government would begin purchasing crude for the Strategic Petroleum Reserve. Oil markets got a temporary boost, but those gains evaporated by the end of the day. The SPR has approximately 100 million barrels of available storage, but there are infrastructure limitations on how fast crude can be injected. Compared to a 6 million barrel per day supply glut, the purchases will do little to boost demand and bring markets into balance.

Market Trends

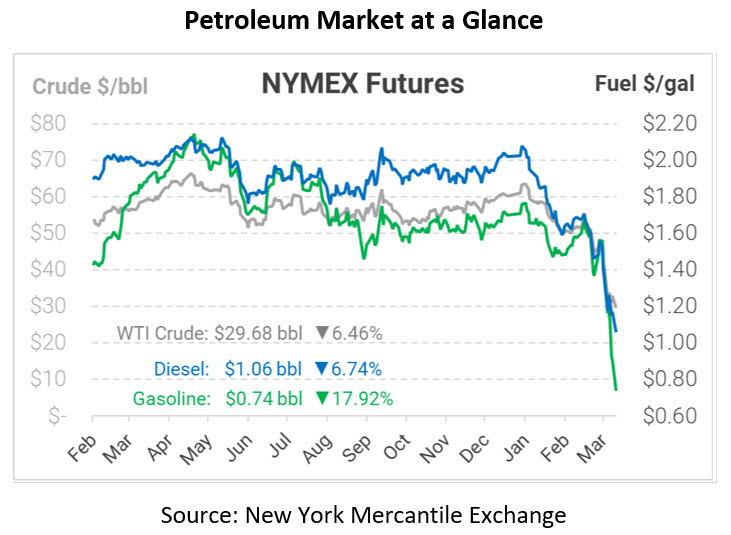

Crude oil prices are slipping once again, now falling below $30/bbl. WTI crude is trading at $29.68, down $2.05 per barrel. Brent crude oil is also suffering, and the spread between the two products is now less than a dollar.

Fuel prices were hit hard over the weekend, especially gasoline. Gasoline prices are trading at an astounding $.7381, down 16 cents from Friday’s close. Diesel prices are trading at a relatively lofty level of $1.0607, down 7.7 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.