Markets Turn Higher, But Long Recovery Road Ahead

After a week of panic selling and market struggles, both equities and commodities are beginning to find their footing, providing a reprieve (however brief) from the bear market. Of course, it’s hard to determine how much of today’s rally is short covering versus a slow return to normalcy.

While equities have been spooked by coronavirus demand concerns, oil markets are even more focused on the Saudi-Russia oil price war. Between demand destruction and oversupply, Goldman Sachs now estimates that Q2 will bring a 6 million barrel per day net build in inventories – a mind-boggling figure. Back in 2015-16, the average daily build in inventories was roughly 1.5 million barrels – a quarter of what’s expected in Q2, yet still enough to cause markets to plummet from over $100/bbl to $30/bbl. With inventories already fairly high, a 6 MMbpd build could very quickly overwhelm global inventory capacity, causing severe volatility in oil prices.

Both Saudi Arabia and Russia appear committed to the oil price war, despite its high cost. According to Reuters, Middle Eastern countries have lost half a billion dollars per day amid the price crash. Russia seems happy to continue pumping oil to steal market share back from US shale producers, who have much higher production costs. Saudi Arabia, backed into a corner, is retaliating against Russia to make them feel the pain.

What they’ve forgotten is the resilience of US shale – the moment the 2015 price war ended and OPEC resumed cuts, US shale companies mounted a remarkable comeback. While it’s true that many Permian companies will go out of business, many more will spring up once Russia and Saudi Arabia give up their fight.

The next opportunity for the two countries to make amends is the June OPEC meeting. While conversations could occur before then, many expect Saudi Arabia and Russia to continue inflicting pain for at least the next few months. Backing down now would show weakness, despite the cost. Still, at least one Russian commentator expects a resolution within the next two weeks. Whenever the resolution comes, expect a very fast snap-back in oil prices. Once the supply end of the equation is brought under control, markets will only need to worry about the demand side…though that will also bring plenty of volatility and uncertainty over the coming months.

Today’s Market Trends

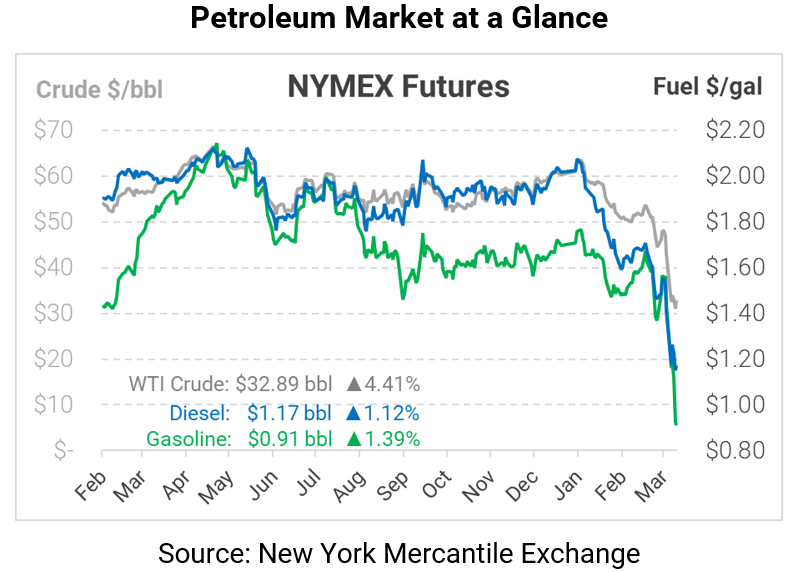

Crude oil prices are springing back with 4% gains this morning, reacting favorably to economic stimulus plans that will help once recovery plans begin. WTI crude oil is currently trading at $32.89, up $1.39 from yesterday’s close.

Fuel prices are also seeing some small gains. Diesel is currently trading at $1.1728, up 1.3 cents. Gasoline, still trading well under a dollar a gallon, is currently at $.9100, also up 1.3 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, crude, Daily Market News & Insights, diesel, gasoline, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.