Russia States it is Still Part of OPEC+

Yesterday, crude rose following equities higher even in the face of somewhat bearish API inventory news. Crude prices are down this morning, giving back some gains in overnight trading. Prices were pressured by Saudi Arabia’s plan to boost oil production and weakened demand caused by the coronavirus. In a further sign that Saudi Arabia is making moves for a long-term shift to market share, the Saudi energy ministry has directed producer Saudi Aramco to raise its output capacity to 13 mmbpd from 12 mmbpd. (Bloomberg)

According to Reuters, Russian Energy Minister Alexander Novak said Saudi Arabia’s plans to increase production capacity were “probably not the best option.” Russia still plans to be involved with the OPEC JTC meeting on March 18th and Novak stated that Russia is still part of OPEC+. Novak also stated that the OPEC+ charter remains unchanged and that co-operation is still ongoing.

The API’s data last night:

The API reported a larger-than-expected build for crude of 6.4 MMbbls versus an expected build of 2.3 MMbbls. The API reported distillates had a larger-than-expected draw and gasoline had a larger-than-expected draw. The EIA will report numbers later this morning.

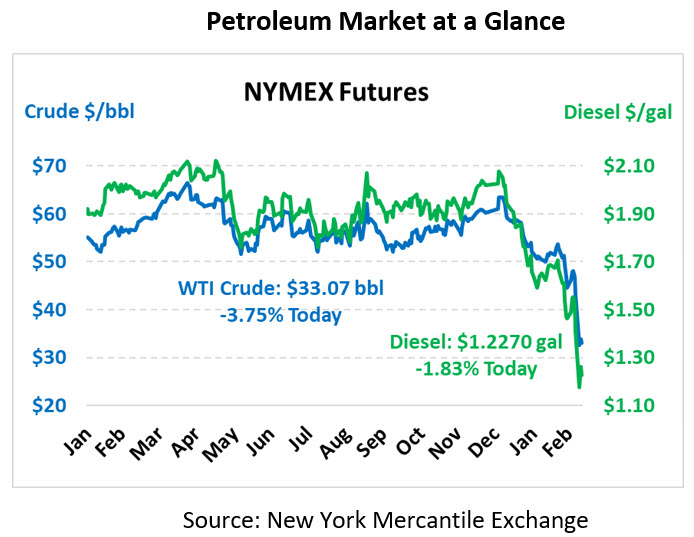

Crude prices are down this morning. WTI Crude is trading at $33.07, a loss of $1.29.

Fuel is down in early trading this morning. Diesel is trading at $1.2270, a loss of 2.3 cents. Gasoline is trading at $1.1222, a loss of 3.5 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.