Russia Rejects Deeper OPEC Cuts

Oil prices are tumbling once again to multi-year lows this morning on news that Russia has spurned OPEC’s recommendation to cut production by an additional 1.5 MMbpd through Q2 2020. The agreed deal would be split, with 1 MMbpd coming from OPEC and the remaining 500 kbpd coming from non-OPEC producers like Russia. The group also suggested extending current cuts through the end of the year, something which Russia is more likely to follow along with.

The economic impacts of the virus have been severe. Mansfield has seen many companies cancelling meetings, and several major tradeshows planned for March have been cancelled or rescheduled. This is exactly the type of economic dampening that equity and commodity traders have feared, leading to heavy selloffs in stocks and commodities.

As we said a few weeks ago in FN – central bank liquidity will help the economy eventually but won’t have an immediate effect. We’re now in the part of the narrative when things get “worse” before they get better. How much worse they’ll get is yet to be seen. For consumers, though, the low-price environment has provided an optimal opportunity to lock in low prices for the future. Oil markets have rarely sustained prices below $40 for long – lower prices force oil companies to cut back output, bring markets back into balance.

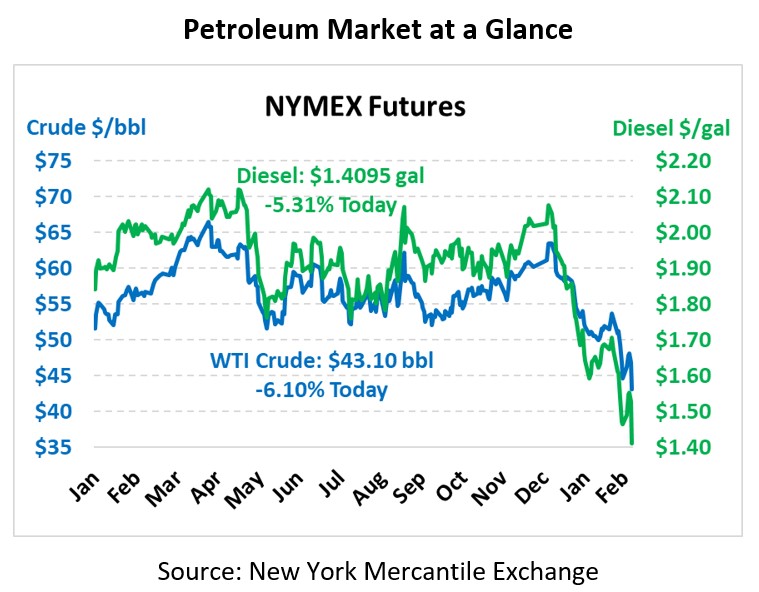

Crude oil is continuing its tailspin to multi-year lows this morning. Crude oil is currently trading at $43.10, down $12.80 (-6.1%) per barrel.

Fuel prices fell significantly in overnight trading, and the first 15 minutes of open markets saw prices fall by an additional 3 cents. Diesel prices are $1.4095, down 7.9 cents (-5.3%) from Thursday’s closing price. Gasoline prices are trading at $1.373, down 8.5 cents (-5.6%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.