Oil Demand May Fall This Year – That’s Not Normal

After a few attempts at a rally yesterday, crude prices ended the day lower, though fuel prices managed to eke out some moderate gains. Despite a relatively bullish EIA report, markets were unable to overcome the sluggish economic outlook. Banks have taken a pessimistic view of prices and oil fundamentals, with Goldman Sachs now forecasting that global oil demand will fall for just the fourth time in 40 years. Morgan Stanley also cut its growth forecast, but still expects 2020 demand to rise by 500 kbpd relative to 2019. OPEC has now proposed an additional 1.5 MMbpd in cuts, dependent on Russia and other non-OPEC countries pitching in.

Yesterday brought further central bank easing to follow the US’s 50-point rate cut. Canada followed America’s lead with its own 50-pt cut, while Europe and Japan added liquidity to help bolster markets. Lower interest rates make bonds less attractive, pushing investors to stocks. That explains the huge rebound in equity markets yesterday, even as commodity prices suffered. While central banks may be propping up stock markets, there’s not much they can do to jumpstart commodity demand when planes aren’t flying and anxious consumers aren’t driving.

The EIA’s data showed falling refinery utilization, which helped facilitate the draw in product inventories. Excluding gasoline inventories, which set new record-high levels in February, inventories have been right in line with seasonal averages. Crude inventories are seeing steady gains as refineries undergo pre-summer maintenance, diesel stocks are falling due to slowed refinery activity, and gasoline inventories are just beginning their early spring drawdowns. Despite the slowdown in global demand, US exports have continued their strong growth, currently 30% higher year to date than this time in 2019.

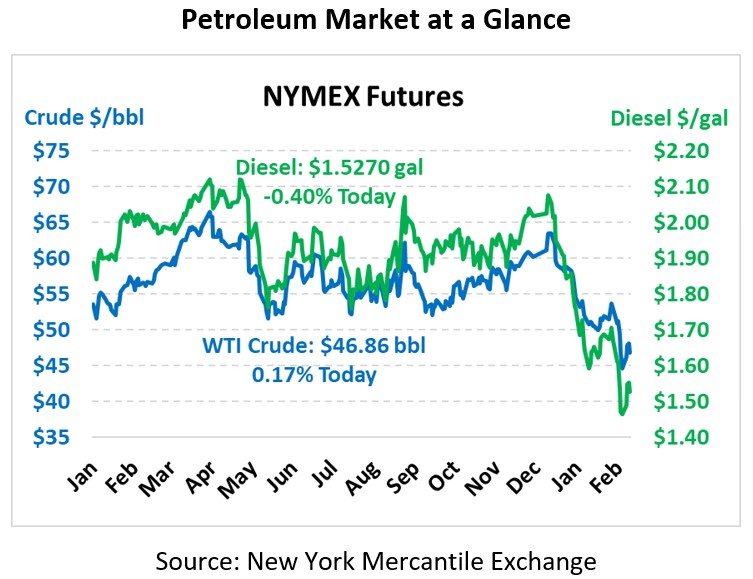

Fuel prices are currently mixed with some products up and some down. Crude oil is currently trading at $46.86, trading flat with yesterday’s closing price.

Diesel prices are trading at $1.5270, down 0.6 cents. Gasoline prices, gearing up for summer demand, are continuing its push above diesel prices. Currently, gasoline is trading at $1.5609, up 0.5 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.