Market is Rebounding Ahead of OPEC+ Meeting

Yesterday, crude prices rose more than 4% on hopes of Russian compliance with OPEC+ supply cuts. Russia stated that they have not received a proposal from OPEC+ for a 1 mmbpd cut in oil output and is instead focusing on an earlier recommendation from the group’s technical experts. OPEC+ is meeting this week in Vienna and according to Bloomberg, the market is currently pricing in around a 0.75 mmbpd cut.

In early trading this morning, crude prices are continuing their rebound from last week’s multi-year lows. According to Bloomberg, OPEC’s output dropped again last month as the group’s voluntary cutbacks were amplified by the conflict that halted exports from Libya; production declined by 480 kbpd to 27.91 mmbpd in February, the lowest since 2009 when the group had just slashed supplies during the global financial crisis.

Tennessee is recovering from devastating tornadoes in the region, including passing through downtown Nashville overnight. The tornado tore through the John C. Tune airport, overturned tractor trailers, and destroyed several power lines. At least nine casualties have been confirmed so far from the tornado, and 20 others have been hospitalized. Winds were estimated to be 136-165 mph travelling through a heavily populated area. Currently 44,000 Nashville Electric customers are without power. Some local fuel terminals are offline, causing severe fueling delays at nearby terminals.

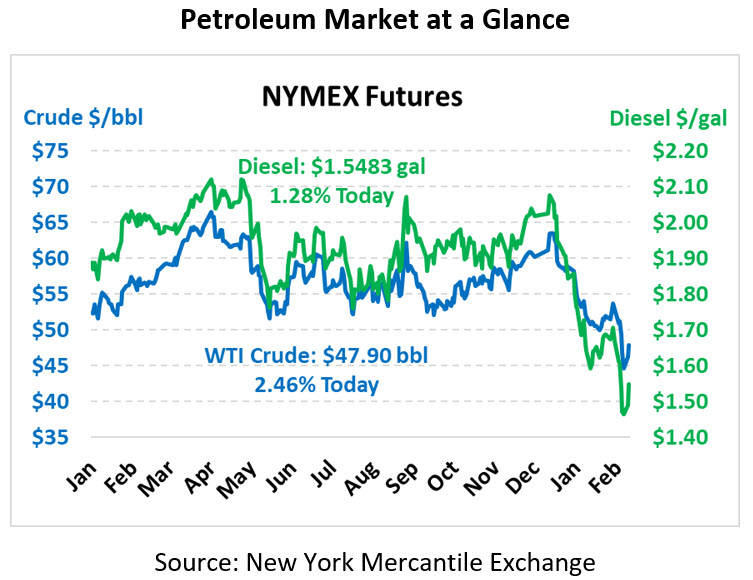

Crude prices are up this morning. Crude is currently trading at $47.90, a gain of $1.15.

Fuel prices are also up. Diesel is trading at $1.5483, a gain of 2.0 cents. Gasoline is trading at $1.5650, a gain of 2.5 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.