As Virus Spreads, Saudis Consider Steep Cuts

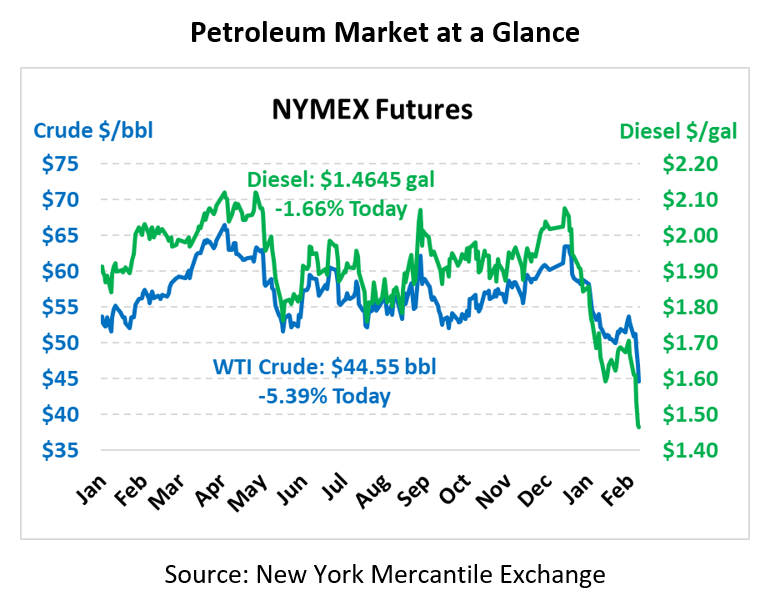

Oil markets are continuing their steep drop, in a sell-off reminiscent of the price crashes seen in 2015-16 and, before that, in 2009. Crude oil and diesel prices have shed nearly 30% of their value since the beginning of the year, while gasoline losses are around 22%. Crude prices are at their lowest level in over a year, while diesel is at multi-year lows. In light of the rapid price drop, oil markets are increasingly expecting OPEC to step in to stabilize the market.

OPEC is expected to meet in March to discuss deepening production cuts. In February, an OPEC committee announced that cuts should be increased by 600 thousand barrels per day, though Saudi Arabia is reportedly mulling even steeper supply reductions. Russia remains the holdout and has yet to clarify its position regarding further supply control. However, data does show that Russian production fell this month for the first time since October.

While OPEC may step in to curb volatility, they have their work cut out for them. Even as the infection rate in China is slowing, infections outside the country are growing rapidly. The virus has spread to 55 countries and territories outside of China, with 4,200 cases reported and 70 deaths. As travel slows around the world, fuel inventories are building up, which will keep downward pressure on fuel prices. As companies deal with full storage tanks, they will need to heavily discount their fuel to move product, so expect significant volatility for fuel markets around the world. So far, the cases in the US have been concentrated on the West Coast, but as panic spreads we may see demand fall more quickly.

In local news, a train carrying crude oil near Chicago was derailed yesterday, impacting nearby fuel terminals. The train fell off the tracks near Citgo pipelines, causing the company to temporary shut off production out of caution. OPIS cited sources saying the pipeline operators will only need a few days to resume normal operations. In a win for crude-by-rail and the environment, no spills were reported despite 18 crude oil tanker cars being derailed.

Market Trends

Crude oil is currently trading at $44.55, down a whopping $2.50 (5.4%) from yesterday’s close. Covid-19 demand concerns are keeping steady pressure on oil markets. Many had predicted that prices would continue sinking before eventually turning around later on due to fiscal stimulus in China and elsewhere. When that stimulus will begin taking hold is yet to be seen, but between OPEC and economic stimulus packages, markets will need to find a bottom sometime between now and next month.

Fuel prices are also cratering, though to a smaller degree than crude. Diesel prices are currently trading at $1.4645, down 2.5 cents (-1.7%) from Thursday’s closing price. Gasoline prices are at $1.3683, down 4.2 cents (-3.0%).

This article is part of Crude

Tagged: COVID-19, crude, Daily Market News & Insights, diesel, gasoline, market trends, opec, Saudis

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.