Fifth Consecutive Down Day for Crude

Yesterday, bullish inventory news reported by the EIA began a small rally that was quickly overcome by more pessimistic coronavirus news as the market digested a rise in new coronavirus cases outside China fueling fears of a pandemic that could slow the global economy. This morning crude prices are lower, falling to their lowest levels since January 2019. The crude market has experienced its fifth consecutive down day and any bullish sentiment seems to be quickly overshadowed by coronavirus fears.

US President Donald Trump sought to assure Americans during a press conference on Wednesday evening that the risk from COVID-19 remained “very low”, but Asian markets fell on Thursday morning. (Reuters) Trump also put Vice-President Mike Pence in charge of efforts to control the COVID-19.

The White House had publicly sought $1.25 billion in new funds and the authority to redirect another $1.25 billion from other programs to combat the coronavirus in the US. But at the press conference late Wednesday, President Trump signaled a willingness to dramatically increase his budget request if lawmakers were willing to allocate more money.

The EIA reported a smaller-than-expected build for crude of 0.5 MMbbls, versus an expected build of 2.0 MMbbls. At Cushing, the EIA reported a 0.9 MMbbls build. The EIA reported distillates and gasoline had larger-than-expected draws.

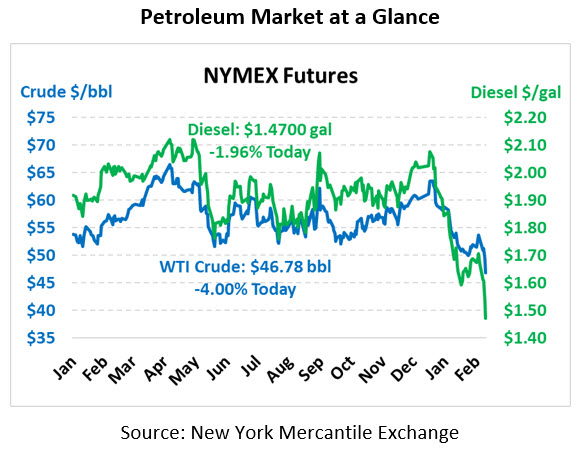

WTI Crude is trading lower this morning at $46.78, a loss of $1.95.

Fuel is down in early trading this morning. Diesel is trading at $1.4700, a loss of 2.9 cents. Gasoline is trading at $1.3827, a loss of 7.2 cents.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.