Crude Reaches Highest Level This Month

Yesterday, oil prices reached their highest level this month as US sanctions on Russian oil company, Rosneft, and unrest in Libya added more uncertainty and concerns for the global crude supply.

Crude prices are up this morning on optimism that China will enact economic stimulus to soften the demand destruction caused by the coronavirus. Chinese refineries are throttling back production even further to cope with weak demand and a lack of workers due to the coronavirus and are now processing 25% less oil than they were last year. (Reuters) To put that into perspective, China is the world’s second largest consumer of crude consuming about 13.5 MMbpd. A 25% drop is about 3.4 MMbpd which is almost as much as was lost by Saudi supply in the September 2019 attack by Iran.

OPEC+ sent out invitations for meetings between the cartel and its allies on March 5th and 6th, delegates said, signaling that plans for an emergency gathering have faded away; Saudi Arabia’s Energy Minister still stated that “a fire brigade” response is needed at the upcoming meeting to put out the “fire” caused by the coronavirus. (Bloomberg)

The API’s data last night:

The API reported a larger-than-expected build for crude of 4.2 MMbbls versus an expected build of 2.5 MMbbls. At Cushing, stocks rose with a build of 0.4 MMbbls. The API reported distillates had a larger-than-expected draw and gasoline had a surprise draw. The EIA will report numbers later this morning.

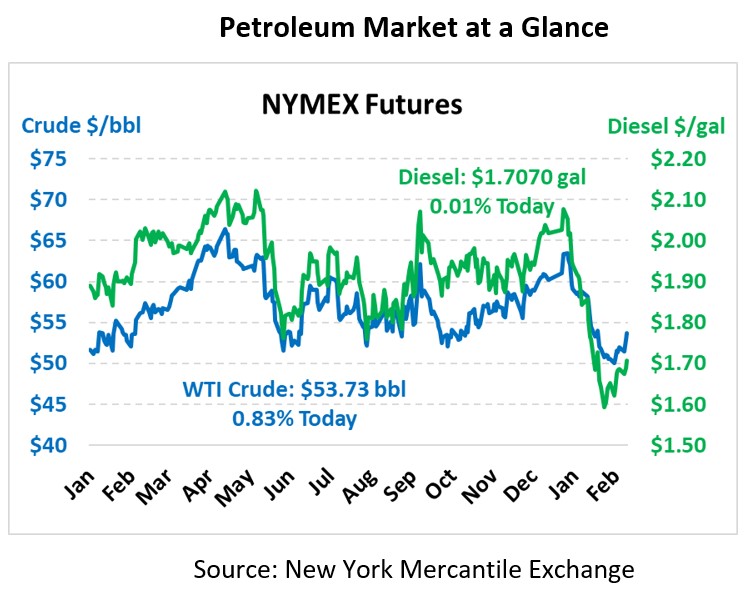

Crude prices are up this morning. WTI Crude is trading at $53.73, a gain of 44 cents.

Fuel is relatively flat in early trading this morning. Diesel is trading at $1.7070, a fractional gain. Gasoline is trading at $1.6703, a gain of 0.7 cents.

This article is part of Crude

Tagged: China, coronavirus, Libya, oil prices, opec, Rosneft, Saudi Arabia's Energy Minister, Saudi supply, US sanctions

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.