Quarterly Demand Decline 10 Yr Record

The markets are mulling supply cut rumors from OPEC+ this morning along with news of a spike in coronavirus cases reported by the Hubei province in China. The Hubei province is the epicenter of the outbreak. The number of new confirmed cases there jumped by 14,840 to 48,206 on February 12 and deaths climbed by a daily record of 242 to 1,310. (Reuters)

In the IEA’s Monthly Oil Report, the agency reported that oil demand is set to fall this quarter for the first time since the financial crisis in 2009 due to the coronavirus outbreak in China; demand in the first quarter of 2020 is expected to fall by 435 kbpd compared with a year earlier. The report noted it would be “the first quarter over quarter decrease in more than a decade.”

Crude prices are relatively unchanged this morning on mixed inventory news from the EIA with a larger-than-expected build in crude stocks and draws in products. The EIA reported a larger-than-expected build for crude of 7.5 MMbbls, versus an expected build of 3.0 MMbbls. At Cushing, the EIA reported a 1.7 MMbbls build. The EIA reported distillates had a larger-than-expected draw and gasoline saw a small surprise draw.

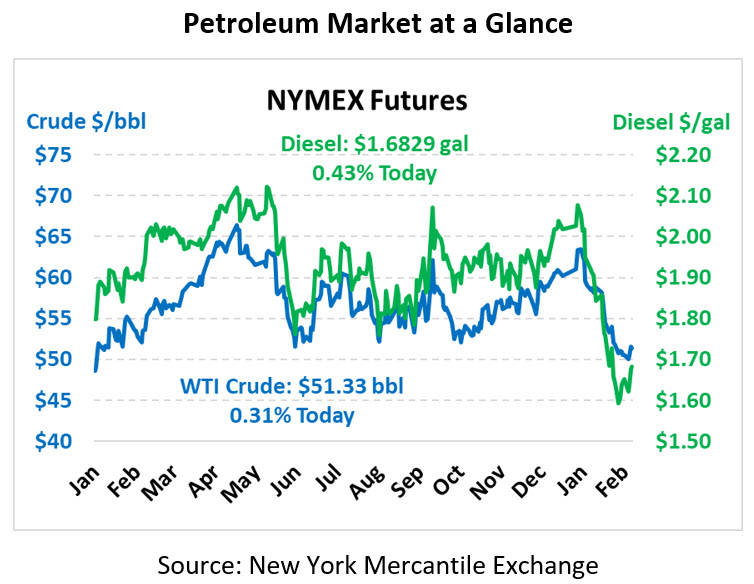

WTI Crude is trading relatively flat this morning at $51.33, a gain of 16 cents.

Fuel is flat in early trading this morning. Diesel is trading at $1.6829, a gain of 0.7 cents. Gasoline is trading at $1.5846, a gain of 0.4 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.